With last week’s price action we updated this article to make sure you take advantage of this price action.

Today’s article is about day trading cryptocurrency and bitcoin trading strategies. You may have heard a lot about it. There are many cryptocurrency trading strategies that promise to make you rich. Our team at Trading Strategy Traders understands that nowadays everyone wants a piece of the pie. That is why we have put together the best Bitcoin trading strategies PDF.

We also have a complete strategy article with a list of all the best trading strategies we’ve created.

Actually bitcoin is the hottest trading market right now. It is hotter than stock trading, oil trading, gold trading and other markets at this point. The reason people believe this will continue to be a hot market is because of blockchain technology. This is what allows transactions to take place without a central exchange. Here is another strategy how to draw trend lines with fractals.

Bitcoin trading for profit is actually a universal cryptocurrency trading strategy. It can be used to trade with any of the 800-plus cryptocurrencies available for trading today. If you’re new to cryptography, it’s best to start with a brief introduction.

How to Start Bitcoin Trading:

The first thing you need to start trading bitcoin is to open a bitcoin wallet. If you don’t have a bitcoin wallet then you can open one at the biggest wallet called Coinbase. We have arranged a special deal for everyone who wants to get started in bitcoin to get $10 free on Coinbase. Get $10 free by opening your Coinbase account here.

Bitcoin traders are actively looking for the best solutions for trading and investing in bitcoin. We have some of the best methods explained here in this article. We’ve learned this bitcoin wisdom through trial and error and we’re going to show you what’s happening right now. The method we teach does not depend on the price of bitcoin. They can be used whether bitcoin is going up or down.

Keep in mind that there is a possibility of losing money. Your capital is at risk when trading cryptocurrency because it is still trading at the end of the day. We always recommend that you demo trade before risking any real money. Also, read the volume guide.

This bitcoin strategy can also be used to trade bitcoin cash as well as other cryptocurrencies. In fact, you can use it as a trading guide for any type of trading instrument. Blockchain technology is a big step forward for information. Many companies are starting to develop applications to use Blockchain to support them. Remember that when trading digital currency, it may look like it is not real currency. But the truth is. This is not a Ponzi scheme. Before you buy bitcoin, have a solid plan in place and don’t underestimate the cryptocurrency market. You must perform your technical analysis as if you would trade any other instrument. You can also read our best Gann Fan trading strategies.

Top Exchanges for Trading Bitcoin & Cryptocurrencies

One of the reasons why Bitcoin is so popular among day traders is that there are many different Bitcoin exchanges available. Finding the best Bitcoin exchange depends on many different factors. This includes your country of origin, payment method, fees, limits, liquidity requirements, and other preferred factors.

Here are some of the top cryptocurrency exchanges on the market:

-

- Coinbase is the largest crypto exchange in the world. Available in the United States, Canada, and most countries in Europe. Offers several payment options.

- Binance is the second largest exchange selling more than 130 different currencies. Has a low transaction fee (0.1%).

- Bitmex is the third largest exchange and only sells BTC. Great for short trading and margin trading.

- Bittrex is a US-based exchange founded by a former Microsoft security professional.

- Robinhood is a new exchange with 6 million users and takes zero trading fees.

- OKEx is a Hong Kong based exchange. Trade more than 145 different cryptocurrencies.

- GDAX – A US-based exchange that allows users to trade Bitcoin, Ether, Litecoin, and other cryptocurrencies.

- itBit operates as a global over-the-counter (OTC) trading desk and global Bitcoin exchange platform.

- Coinmama – lets you buy and sell easily. Accepts credit cards and has a large global reach.

What is this Free Bitcoin Trading Strategy?

A cryptocurrency is really no different than the money you have in your wallet. They have no intrinsic value. And cryptocurrency is just a bit of data while real money is just a piece of paper.

Unlike fiat money, Bitcoins and other cryptocurrencies do not have a central bank that controls them. This means that cryptocurrency can be sent directly from user to user without any credit card or bank acting as an intermediary. The main advantage of cryptography is that you cannot print it like a central bank to create fiat money.

When you print a lot of money, inflation increases so the value of the currency goes down. There is a limited amount of Bitcoins. This is true for most other cryptocurrencies. The supply side cannot increase which makes Bitcoin less vulnerable to being affected by inflation.

Now, let’s move forward and see how we can profit from cryptocurrency mania. We will use our best Bitcoin trading strategy. We also have training for the best short-term trading strategies.

How is Bitcoin Trading Day?

While long-term traders choose to hold their bitcoin positions for long periods of time, day traders have found that Bitcoin is lucrative for many reasons:

- Crypto trading is more volatile than stock trading.

- Bitcoin is traded 24 hours a day 7 days a week.

- Bitcoin enables large trades with low overhead.

- Bitcoin is the most liquid form of cryptocurrency.

- Multiple trading opportunities appear within 24 hours.

Since Bitcoin is more volatile than a tradable asset, there will be many profitable trading opportunities that occur every day. As with common currencies, using technical indicators will make it easier to tell when a price rally is likely to occur. Volume, relative strength, oscillators, and moving averages can all be used for Bitcoin day trading.

It is important to pay attention to technical indicators and developing trends. In the next step, we will talk about OBV trading and how to start buying and selling cryptocurrencies.

Best Bitcoin Trading Strategy – 5 Easy Steps to Profit

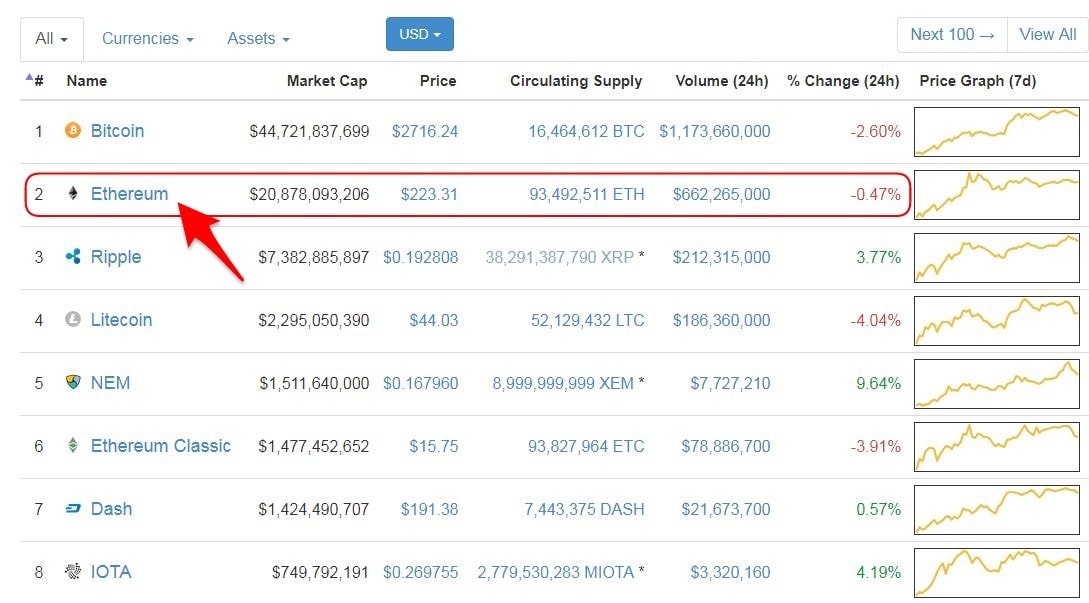

This is a cryptocurrency trading strategy that can be used to trade all important cryptocurrencies. In fact, this is an Ethereum trading strategy just like a Bitcoin trading strategy. If you don’t know Ethereum is the second most popular cryptocurrency (see picture below).

The best Bitcoin trading strategies are 85% price action strategies and 15% cryptocurrency trading strategies that use indicators.

Now …

Before we move forward, we must define a mysterious technical indicator. You need this for the best Bitcoin trading strategies and how to use them:

The only indicators you need are:

On Balance Balance (OBV): This is one of the best indicators for day trading bitcoins. It is used to basically analyze the amount of money flow in an instrument. OVB uses a combination of volume and price activity. This tells you how much money is in and out of the market.

OBV indication

The OBV indicator is available on most trading platforms such as Tradingview and MT4. How to read information from the OBV indicator is quite simple. Here you can learn how to profit from trading.

In theory, if Bitcoin is traded and at the same time OBV is traded, this is an indication that people are selling into this rally. The upward trend will not continue. And vice versa if Bitcoin is traded and at the same time OBV is traded.

What we want to see is OBV moving in the same direction as Bitcoin price. Then, you will learn how to use this information along with cryptocurrency trading strategies.

No technical indicator is 100% effective every time. In this regard, our team at Trading Strategy Traders uses the OBV indicator with other supporting evidence to maintain our trades and get more confirmation. The next step comes from the Ethereum trading strategy that will be used to identify Bitcoin trading.

Now, before we go any further, we always recommend taking a piece of paper and a pen and note the rules of the best Bitcoin trading strategy.

Let’s get started … ..

Best Bitcoin Trading Strategy –

(Rules for Buy Trade)

Step #1: Overlay Bitcoin chart with Ethereum chart and OVB indicator.

Your chart setup basically has 3 windows. One for the Bitcoin chart and the second for the Ethereum chart. Finally, create a window for the OVB indicator.

If you follow our cryptocurrency trading strategy guidelines, your chart should look like the one in the figure above. For now, everything should be fine, so it’s time to move forward to the next step of our best Bitcoin trading strategy.

Step #2: Finding Smart Money Differences between Bitcoin price and Ethereum price.

What do we mean by this?

In short, we will look at the price difference between the price of Bitcoin and Ethereum. Smart money divergence occurs when one cryptocurrency fails to confirm the actions of another cryptocurrency.

For example, if Ethereum price breaks above an important resistance or swing high and Bitcoin fails to do the same, we have a smart money divergence. This means that one of these two point cryptorans is “lying.” This is the main reason why we use this cryptocurrency trading strategy. And Ethereum trading strategy too.

If you are still struggling to identify the support and resistance we receive, read our guide on this topic here: Support and Resistance Zones – The Road to Successful Trading .

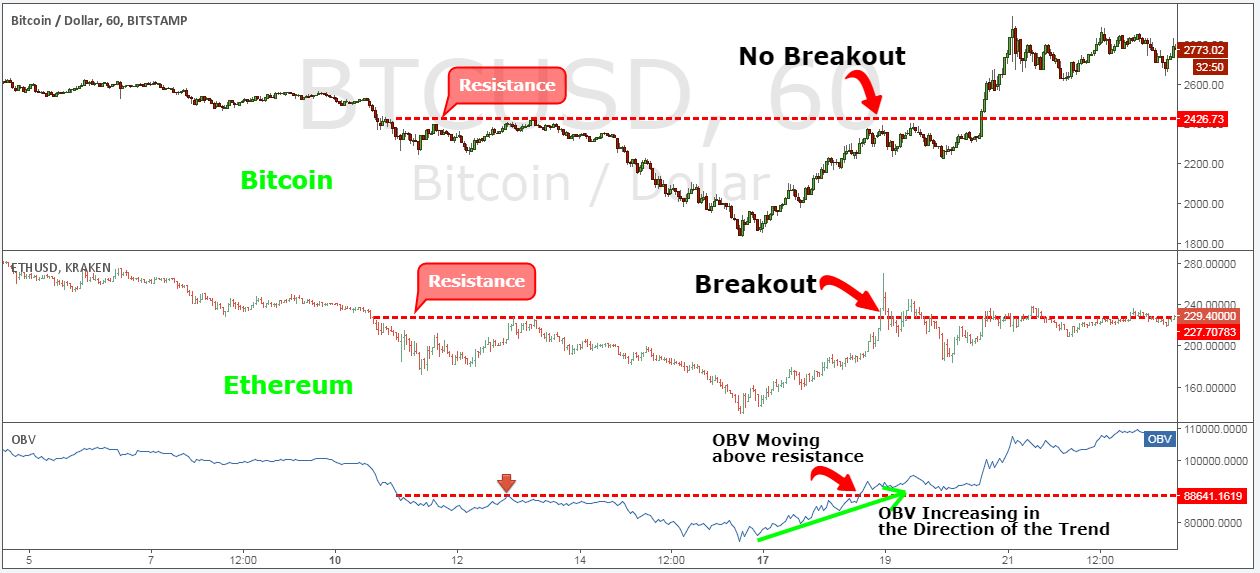

In the figure above, we can see that the price of Bitcoin failed to break through the resistance while the price of Ethereum broke above and made a new high. This is the first sign that the best Bitcoin trading strategy will mark the trade.

The reason why the smart currency split concept works is because the cryptocurrency market as a whole should move in the same direction when we are in a trend. The same principle has been true for all other major asset classes for decades. It is true for cryptocurrency trading strategies as well.

Before buying, we need confirmation from the OBV indicator. This brings us to the next step of the best Bitcoin trading strategy.

Step #3: Look for the OVB to increase the directional trend.

If Bitcoin lags behind the price of Ethereum, it means that sooner or later Bitcoin should follow Ethereum and break through the resistance.

But, how do we know that?

In short, OBV is an outstanding technical indicator. It can show us if real money is really buying Bitcoin or if they are selling. What we want to see when Bitcoin fails to break a resistance level or swing high, and Ethereum is already broken, is for OBV to increase in the direction of the trend. We also want it to move above the level when Bitcoin was previously trading at this resistance level (see image below). Here’s how to recognize the right swings to increase your profits.

Now, all we have left to do is to place our buy limit order, which brings us to the next step of the best Bitcoin trading strategy.

Step #4: Place a Buy Limit Order at the resistance level in an attempt to catch a possible breakout .

Once the OBV indicator gives us a green signal, all we need to do is to place a buy limit order. Place the order at the resistance level in anticipation of a possible breakout.

It is not surprising to see this trade trigger and for the price of Bitcoin to break higher than expected. After all, we told you OBV is an amazing indicator.

Now, all we need to determine is where to place our stop loss protection and when to take profit for the best Bitcoin trading strategy.

Step #5: Place your SL under the breakout candle and take profit once the OBV reaches 105,000.

Placing a stop loss below a sailing candle is a smart way to trade. We have written more about the reasons to hide your SL above / below breakout candles in our latest article here: Breakout Trading Strategies Used by Professional Traders.

When it comes to taking our profits, usually an OBV reading above 105,000 is an extreme reading that signals at least a pause in the trend. This is where we want to take advantage.

Note ** The above is an example of a buy trade… Use the same rules – but in reverse – for a sell trade. In the picture below, you can see an example of a real SELL trade, using the best Bitcoin trading strategy.

How to Improve This Bitcoin Day Trading Strategy

Although bitcoin day trading has some risks, there are many ways these risks can be mitigated. Here are some of the best ways to improve your Bitcoin trading strategy.

Remember to:

- Diversify your trade. Combining Bitcoin, Ripple, Litecoin, Ethereum, and other cryptocurrencies will help reduce the daily risks associated with certain coins.

- Reduce trading costs. Opening multiple positions every day affects your daily ROI. To minimize trading costs, choose a reliable exchange that has low fees.

- Watch the trading time. Plan trading times that are compatible with your schedule. Bitcoin trades 24 hours a day. It differs from the 9-5 NYSE.

- Follow Bitcoin News. Keep an eye on cryptocurrency news stories to stay ahead of the market. Provide warning signs and other types of notifications.

- Use technical analysis . Use strong technical indicators like OBV. This will help you justify each of your trades.

- Use stop loss. Set a stop-loss order on each trade. Start with a profit loss ratio of 2:1.