Nadex is a fully regulated trading exchange, regulated by the CFTC (Commodity Futures Trading Commission), and legally permitted to accept US residents as clients. Nadex operates in the United States, but is part of the London-based IG Group. They offer real exchanges, with both buying and selling fully open to traders.

Delivering advanced trading tools, and advanced features, Nadex provides a high quality trading experience. Fully documented exchange fees highlight Nadex’s transparent nature to their service. They describe their business as:

” Serving the function of buyers and sellers matching the contract in an unbiased way (Nadex does not profit from the gains or losses in the trade, instead it only receives the full exchange fee) ”

Summary of the Study

- Nadex Demo Account – Yes (Open a free demo account )

- Minimum Deposit – $250

- Minimum trade – $1

- Bonus details – No bonus scheme is currently active.

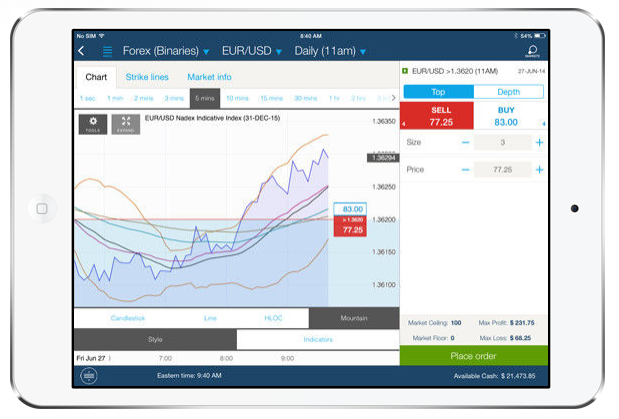

- Mobile App – NadexGo.

- Signal service – No

Nadex offers their clients the following features and benefits:

- Transparent trading costs – Nadex is clear about how they are funded.

- Advanced Charts – Charts and technical analysis tools are among the best in the binary options sector.

- Education – This firm takes trader education to the next level. There are regular free webinars on not only how to use the platform, but how to make consistent profits.

How to Use Trading Platforms

Nadex provides a real exchange trading experience. This means traders have the option to buy or sell on either side of the asset. Traders can also request their own strike price. If there are other customers who want to trade on the other side, then it will be opened at that price.

The first choice made is the asset to trade. This can be found through the ‘Finder’ window on the left side of the trading platform. Selecting a market opens the time frame offered for option expiration (time listed in Eastern Time).

The market window will refresh when the expiration date and asset have been selected. This will display the current price level that can be traded. Generally, there are about 10 price levels – for example, trading with the Nasdaq offers 10 levels. Each level is traded based on whether the closing price (the price at expiration) will be above or below the indicated level. The settlement price on Nadex binary options is 0 or 100, so the exchange price will fluctuate between 0 and 100. 100 is a positive outcome, (so the asset settles above or below a certain price) and the option will settle at zero where the option have a negative outcome, so for example if the asset price does not finished above the target price. Remember traders can buy or sell both positive, or negative outcomes.

Clicking on an asset in the market list, or the ‘Bid’ or ‘Offer’ figure – will trigger the trade ticket screen to open. If the bid or offer button is clicked, this will cause a ticket to open with the ‘sell’ or ‘buy’ option selected.

Trade tickets confirm expiration times, price levels, bid sizes and current bids and offers. The user then needs to click the sell or buy button (if not selected) and confirm the size (investment amount) in the trade. The numbers along the bottom of the ticket will highlight the maximum loss and maximum payout based on the scale of the trade entered – the ‘max loss’ can be intimidating, but traders can close the trade at any time if the price moves against them. Traders can also change the Price – this is an element of the Nadex trading exchange . Traders bid at a higher or lower level than the current price to wait and see if their position is ‘matched’.

As each option is open tradeable, clients can close their open trades at any time – so profits can be taken, or losses reduced. The maximum and minimum numbers on the ticket represent the two outcomes if the option is allowed to expire without further trading.

Once the trade is set as required, the trader clicks the ‘Order Place’ button. Once matched, it will appear in the ‘Open position’ window. If the trade is ‘unmatched’ (either in whole, or in part), it will move into the ‘Work Orders’ screen. Both ‘Open Positions’ and ‘Working Orders’ will be updated when orders are matched. In addition to this window, Nadex will also send an email confirmation. Another mail is also sent confirming when an order is completed.

Trading options

Nadex offers binary trading on forex pairs, commodities (gold, silver etc) and stock indices. There are various price levels for each asset, so if a trader is looking for a quick price move in a particular stock index, or a long-term trade in a currency pair, Nadex will provide it.

Nadex offers more than 5000 contracts to trade at any one time.

Touch the Bracket ™ contract

The Nadex Touch Bracket ™ contract is a new type of contract that Nadex has introduced. This contract operates between two ‘bracket’ (floor price, and ceiling price). The price moves with the real asset price between these price levels. The appeal of these levels is that they act as a built-in, no-slip – guaranteed risk management tool. The cost of opening a trade is the maximum capital at risk.

Flexible micro trade sizes mean these contracts can be secured with low capital requirements for beginner investors, but scaled up for professional traders to get the most out of their leveraged trades.

Mobile App

Nadex offers one of the most comprehensive and comprehensive mobile trading applications on the market. The app is free, and has been written and optimized for various mobile platforms. This application is called NadexGo

The operation of the application is smooth, fast and important, containing every feature available on the full website. Account maintenance to note, everything is there for the trader in the trading application.

The layout is clear while still showing all the data a trader needs, making trading very easy. The trading ticket trading area is the same as on the full website platform, as it has been optimized for ease of use.

The NadexGo mobile app includes every feature of the full website, and leads the way in the binary options sector.

Call Call Spread

Payments at Nadex are not easy compared to other brokers – other brokers do not offer genuine exchange trading. Binary options will be paid depending on the strike level that the trader can open the option at.

For example, if a trader brings at 50 and makes it 100, the payout is effectively 100% (they can risk $100 for example, and receive $200 when the trade is completed), but if they bring at 70 and make up is 100 then the payment goes down to around 50% (Amount with higher risk and less profit).

Note that there is a trading fee incurred for opening a trading position as well as closing a position before expiration which is $1 per one-way contract. Otherwise, contracts held until expiration will incur a $1 per contract settlement fee if settling money. These charges are transparent (you’ll know exactly what each trade will cost), and still represent ‘better value’ trades, than more traditional options. Full details of Nadex fees can be found on their website.

Complaint

Nadex does not produce many complaints. Traders sometimes struggle with the platform because it is so different from the more well-known ‘broker’. These demo accounts give traders a chance to familiarize themselves with the platform before trying new strategies, but users can feel frustrated where confusion with the platform has resulted in lost or lost trades.

The educational material provided by the firm is excellent. The platform is unique, and requires specialized training materials. Among the tools from videos, manuals and websites also run a series of regular webinars for traders to conduct lessons in live trading setup. Once mastered, the exchange platform works easily with more common platforms. The fees charged for trading are clear and transparent, and again, not likely to cause complaints.

The brand is definitely not a scam. Owned and operated by IG Group in London, which is operated by FCA in the UK. US exchanges are overseen and regulated by the CFTC to offer trading to US residents.

The rules for the firm could not be stricter, and users can login, deposit and trade with absolute confidence.

Withdrawal and Deposit Methods

Nadex allows US residents to fund their accounts via debit card, ACH transfer to wire transfer. Non-US residents can use debit card, or wire only;

If the wire transfer exceeds $5000, Nadex will refund the $20 banking fee into the trading account.

Withdrawals are only available via ACH or wire transfer. Non-US residents can only use wire transfers. Withdrawal options can be found in the ‘Account funding’ menu in ‘My Account’. Issuing an ACH transfer is free and takes approximately 3 to 5 days, while a wire transfer requires a $25 fee to be paid, but is usually processed the next day.

Withdrawal details are not straight forward with Nadex, so it’s worth clarifying them well before attempting to request payment. Many of these stages are required due to CFTC regulations – but delays are a common problem among traders and their brokers – it’s an area to research carefully before funding an account. This ensures there are no surprises and the merchant knows what to expect when requesting a withdrawal.

Frequently asked questions

Nadex is regulated by the CFTC (US Commodity Futures Trading Commission). This represents one of the strongest levels of regulation in the sector.

Who owns Nadex?

Nadex is owned by the UK-based IG Group. They have an office in London, and are listed on the London Stock Exchange. IG Group also operates the UK broker IG Index.

Trading hours?

The Nadex website is available 24 hours a day, but many assets will only be available for trading based on their own regional trading hours. Just like stocks in London, for example, will only be open for trading during UK trading hours but some products such as the S&P500 are traded electronically around the clock. Some Forex pairs are traded worldwide and will therefore be open around the clock on weekdays – but trading volumes will change at certain times.

Is Nadex a broker?

NADEX is not a binary options broker in the “traditional” sense. NADEX is an exchange and the exchange is where traders can meet to do business. Nadex provides the platform, which ensures everything complies with CFTC regulations, and is the clearinghouse for Nadex trades that processes all the money and other necessary tasks.

Every time you trade, you pay a $1 exchange fee for each contract. Remember the exchange makes its money by facilitating trades, not when you lose.

This is important because it clears up any conflicts of interest that may arise when trading with an EU-style broker. NADEX doesn’t care if you win or lose, they charge a small fee for each contract (full details on their website) and this is where their profits come from.

Offshore style brokers make money when you lose, it is not interested in winning that is why the “account managers”, signals and autotraders offered by some brokers are often scams.

What makes NADEX better, and where the real fun comes in, is who facilitates your trades. You trade with other traders like yourself and a market maker who simply serves as a liquidity provider and not a platform that makes the action hotter.

How You Make Money On NADEX

How you make money on NADEX is by buying and selling binary options. This option works just like EU-style binaries in some respects and not in others. On the one hand, they can be held until the end of the period where you will lose everything or receive the maximum payment. Instead they are based on a set strike price and can be bought and sold continuously up to and until expiration.

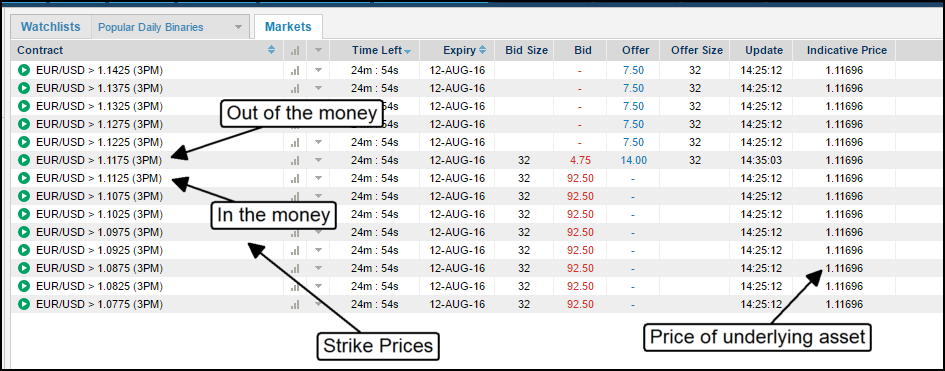

The biggest difference between them and why they trade differently is how they work. EU-style binary options use the price of the asset at the time you make your purchase as the strike price. If the price moves up or down from there, you will lose or make money, depending on the type of option you bought. NADEX binary options are based on a set strike price, selected from a list of possibilities, and can be in or out of the money.

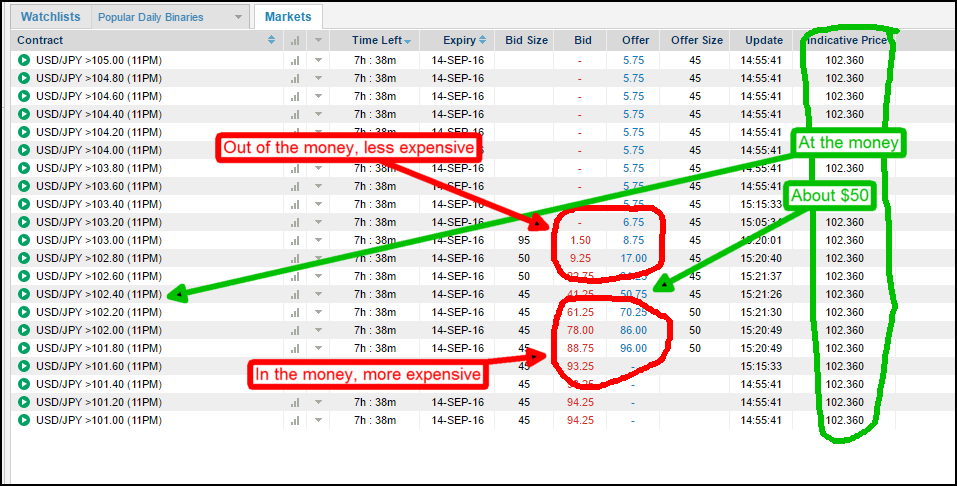

With EU style options you can trade any amount you want, all you do is enter the number in the trade screen. On NADEX options are sold in lots so, for example, you want to buy EUR / USD at 1.0545 you will buy 1, or 2 or 10 lots, whatever you choose. The price of each lot will depend on the strike, if it is in or out of the money, and to some extent market pressure. The option price will run between $0 and $100 dollars, $0 is the minimum payout and $100 is the max. In the money options will naturally be more expensive, out of the money options will be cheaper. If, at the time of expiration, the option closes the money you will receive $ 100 per lot. If the option closes the money you receive $ 0. Before the option expires its price will fluctuate depending on the price of the underlying asset. The profit you make is the difference between what you paid and what you received in the money, $100. Usually, at the money options will cost about $50 which means a trade return of $50, or 100%, the way that better than the 70% to 80% you get with EU style binaries.

Strategy

To say that NADEX binary options are a little confusing for new traders is a bit of an understatement. There are several key differences between CFTC-regulated US binary options trading and the more traditional spot binaries offered by European and offshore brokers. The good news though is that this difference opens up new avenues for trading and profit that would not be available with other forms of binary trading.

Before we move on to the more complicated details of opening and closing NADEX positions, let’s examine the specific differences between binary points and NADEX. Offshore binary options brokers, speaking of standard high/low digital options trading, have two types of positions; call and put. If you go up in price you buy calls, if you go down you buy and in both cases you buy from the broker. If you win the broker pays you, if you lose the broker keeps the money. Soon you can sell options other than the initial state outside. At NADEX they have only one type of position, called a lot, and it can be bought or sold. If you go up in price you buy it, if you go down you sell it.

How to Buy and Sell Work

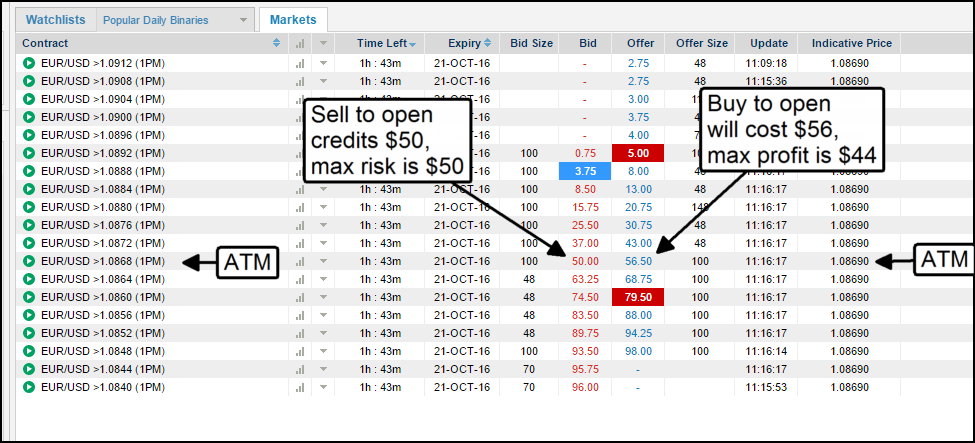

Here’s how it works. Many NADEX lots are listed at different strike prices, some are In-The-Money, some are Out-of-the-Money and one or two will be Near or At-the-Money. For this discussion, I will focus solely on At-The-Money strikes for simplicity and because both long (buy, call, up) and short (sell, put, down) positions will cost about $50 .The thing to remember is that in both cases, buying or selling, you are doing so to open a position. So, buying NADEX lots is the same thing as buying EU-style calls, selling NADEX lots is the same thing, almost, as buying EU-style puts. The difference is that with NADEX you are ALREADY OPENED , right? Buy Open , the position drops until you get CREDITS to do so.

See examples below. In this chart, the NADEX strike to end 1PM EUR/USD strike 1.0868 is In the Money. If you want to buy a long position, a call, it will be charged to your bid price. This is the price at which another dealer is OFFERING TO SELL . If you buy it at $56.00 and the asset price closes above the strike price, In The Money, your maximum profit is $44 which is the difference between what you paid and the maximum payment at expiration, $100. If you want to sell a short position , enter the price, you will receive the offer price. This is the price at which another trader is OFFERING TO BUYoption, in this case $ 50. This means that you will receive a credit of $ 50 into your account and will be able to secure it if the price of the asset closes Out Of The Money (other traders lose, you win). Your risk is if the price of the asset closes In the Money, if this happens, you are responsible for paying the $100 max payout but don’t worry, because you took $50 it really only cost you $50 so your risk is $50.

The easiest and best way to profit from NADEX options is to hold them until expiration at which time you will get the max return. However, some times you may want to close early to lock in profits or cut losses and this is another area where there is confusion.

What you need to remember is that you have already opened a position, now you need to close it. If you have bought a long position, a call (buy to open), then close it you BECOME CLOSED and accept the offer price. If the price exceeds the price you paid for the option then you will make a profit. If you sell a short position, sell to open, then to close it, you need to BUY CLOSE .

Opening And Closing

The important thing is to remember two things. First, there is only one type of position that can be bought or sold to open. The second thing to remember is that to close your position, you must do the OPPOSITE of what you did to open it. If you buy to open you sell to close, if you sell to open you sell to close.

A Beginner’s Guide To NADEX

The biggest complaint about NADEX is that it’s not easy. Granted, NADEX is not as easy as trading on overseas, EU or CySEC digital binary options brokers. In one of the places you need to know is the direction you want and how much you want to risk.

When you hit enter the price of the underlying asset at that time is your strike price, if the asset price moves in the right direction from there you are a winner and pay the percentage shown when you buy the option. At NADEX it is not easy enough but believe me when I say that it is much more powerful than any form of binary trading that I know.

There are three things you need to know when dealing with NADEX:

1. Valuable options in the 0-100 method

Since they are binary there are only two possible outcomes at expiration, either $0 or $100. If the option closes in the money you get $0, if it closes in the money you get $100. The details that make trading work are that even if the option is live, before it expires, the value will fluctuate between $0 and $100 based on the movement of the underlying asset and market pressure. If the option is out of the money it will cost less, if it is in the money it will be more expensive.

Your profit at expiration is the difference between what you paid and what you received. If you pay $45 and receive $100 because the option expires in the money you profit $55 or 122%. Please note that I said 122%, a much better return than you will find anywhere else. Important to note, you don’t have to hold NADEX options until they expire, they can be bought or sold at any time. If your trade is moving in the money and your option is showing profit you can sell but you may not get the maximum return.

2. NADEX binary options trade in “lots” priced by the market

Things that affect price include the price of the asset, the strike price of the option and the amount of time until expiration. At overseas brokers there is no market pressure that affects the price, if you want to trade $500 you enter $500 in the amount box click enter and the trade is done, you have a position of $500. With the “lot system” if you want to sell $500 and 1 (one) lot costs $50, you need to buy 10 (ten) of them. If a lot costs $65, you will only be able to buy 7 (seven) without going over your limit.

3. Strike price

Each asset will have several expiries listed with several strike prices available for each. The strike price is the price level at which the option will go in/out of the money. When it comes to price, At-the-money options will always trade near $50 which indicates a 50/50 chance for the option to move up or down. When the strike price is at-the-money, that is the price of the asset has crossed the strike price, it will be more expensive because there is a higher chance of closing the profit better. Attacks will cost more in the amount of money you do until they are fully worth it. When the strike price is out of the money, that is the price of the asset below the strike price, it will cost less than $50 and will be cheaper the further OTM you go until they are completely worthless. In terms of standard, directional style trading, ITM or ATM options are less risky trades while OTM options are more risky. Of course, with a strong signal an OTM option that costs only $30 or $40 will return 150% to 230%.

Simple Selling Strategy For NADEX Binary Options

NADEX binary options are not like EU style spot binaries, you can actually sell them and get paid. Read on to learn how you can use this simple selling strategy.

Let’s repeat that NADEX options are sold in lots, the option strike is preset at some money and some money, and all options are worth the same $0 or $100 at expiration. During the life of the option, the time between when it first becomes available for trading and the time it expires, the price will fluctuate between $0 and $100 depending on the strike and movement of the underlying asset. In the case of a favorable position, a position where you buy a strike with the belief that the price will move higher, your profit will be the difference between the price you paid for the position and the amount you get back at expiration, either $0 or $100.

If the option goes out of the money and you get $0, you have a loss, the cost of the position. If the option expires in the money you get $100 and experience a profit, $100 minus the cost of the option. If the option is bought at the money, it might cost about $50 and return about $50, or 100%.

Therefore, in the case of a bearish position you proceed in the same way as a buyer. You “sell” the strike, meaning you pay the other side of the position from the buyer you traded it with. If the buyer puts $40, you will pay $60, which is $100 minus $40. The most you can lose is $60. You profit if the option ends at zero, whereas the buyer profits if it ends at $100. In this case, if the binary expires worthless, you will get your $60 back with a $40 buyer, for a $100 payout.

Remember, ATM money options cost about $50 per lot. If you sell one for $50 and it closes in the money you have to pay $100, which is $50 your money and $50 you receive in the option premium. If the option closes the money, which is what you want, you get to keep the premium (the option owner holds a worthless contract, you have to pay nothing) and the profit of that amount.

- Buying On NADEX / Bullish Position – you buy the option strike, pay the ask price, and profit the difference between the option cost and $100. Your risk is the option price.

- Selling On NADEX / Bearish Positions – You sell the strike of the option, receive the bid price, and profit that amount if the option closes out of the money. Your risk is the difference between what you receive and $100.

The mechanism of buying and selling options on NADEX opens up several possibilities. The simplest and perhaps most effective way to trade directional binary options is the hedging strategy. Hedging is when you use one position to offset the costs of another, or help maximize profits before expiration. Think about this. You take a signal on a bullish trade and buy an option ATM for $50. The underlying asset moves to your next resistance target and stall but you can sell the next strike higher for $50 at the same time. This means that your total cost is now $0 dollars, all you have to do is wait until the expiration date. If the asset remains between the two great strikes, you make the maximum return,

More advanced traders can target directionless strategies using put options. These strategies work best in markets, when asset prices are declining or when they are limited by resistance. One method is to target at-the-money strikes that can be sold on credit that are most likely to close out of the money. Take for example this trade set up for the S&P 500. Price is going down in the near term with two strike prices close enough to the money to have value, but far enough away to be relatively safe compared to price action. Please note, this is already in the money so there is no need to NEED price movement. Sell these for $31.50 affiliate credits, free and clear and all you have to do is hold them for 5 minutes.