Binary options bonuses can give you extra money to trade with, sometimes for free without a deposit, but more often as a percentage plus whatever amount you deposit into your account (a ‘deposit match’ bonus).

Binary options brokers are always interested in attracting new traders. One of the main ways to get new habits is to offer bonuses. This can come in many forms, from simple deposit bonuses or risk-free trading, to more complex packages of training aids and hi-tech tools – brokers know how to attract traders, new and old.

Here we list and compare all bonuses 2020 and explain the main points to ensure that any bonus taken is a genuine benefit and not a source of disappointment. We explore some common types of bonuses, and when the right time to take them might be. We also discuss some pitfalls, and why all that glitters, may not be gold.

Top Bonuses 2020 for Traders in Malaysia

What is a Binary Options Trading Bonus?

Binary options bonuses are offers from brokers, designed to provide traders with additional funds to trade with or to reduce losses if a trade goes wrong. Usually the offer is in the form of a welcome bonus, or sign-up offer as it is sometimes also called. The welcome offer is of course also an incentive for new customers to join that particular broker.

They come in many forms, for example:

- No deposit bonus

- Reserve match

- Risk free trading

- Educational materials

- Hardware or gifts

Bonuses will always come with terms and conditions. These conditions are the most important aspect to compare bonuses. For example, a smaller ‘no strings attached’ bonus, may be more attractive than a larger bonus that has some very strict terms and conditions.

Examples of Welcome Bonuses

Let us take an example. The most common form of bonus is the ‘deposit match’. Here, when a new trader opens an account, their first deposit will trigger a bonus. This is usually a percentage of the deposit. So, assuming the deposit is a 50% bonus deal:

- A merchant makes a deposit of $200

- A 50% bonus (In this case $100) will be added to their account

If the deposit match bonus figure is 100%, the same trader will get $200 in bonus funds.

Risk Free Trading

Risk free trading is another easy form of bonus. One attraction of the risk free bonus is that the terms are usually way less strict. Risk-free trading gives traders the opportunity to make a trade, knowing that if it loses, they do not lose anything from their account. If it wins, they keep the profit.

Some brokers will offer 3 or 5 risk free trades, and they will all operate the same way. With more trades come more terms. For example with a risk-free trade, the broker may pay the winnings in cash – immediately available for withdrawal. Where brokers offer more risk free trading, it becomes more likely that any winnings have to be “submitted” (traded) several times before they can be withdrawn.

This is one of the reasons why when comparing bonuses, the term is important. At the end of this page, we explore risk-free trading in more detail, and explain why there are different levels of risk.

No Deposit Bonus

A ‘No deposit’ bonus is the suggested name – a bonus credited to the account without the need for an initial deposit. It is obviously an attractive option for a trader, but as explained above – reading the terms and conditions will be key. No deposit bonds will usually require a very high turnover before any funds can be withdrawn, and this requirement usually needs to be met within a short period of time.

Given the demanding terms and conditions, it becomes clear that a live account, with a ‘no deposit deposit’, will actually behave in the same way as a demo account. The reason is that these bonus funds cannot be withdrawn and are not “real money” until certain, strict criteria have been met.

This type of bonus is also rare. It doesn’t work well for brokers, or traders. Recent months have seen a move away from no deposit bonuses, into ‘risk free’ trading. This allows traders to use the live money platform, but place a handful of trades without financial risk. Brokers now tend to offer either risk-free trading, or deposit match bonuses.

Best Time to Claim Bonus

The best time to claim interest is often not at the stage of making the first deposit. With some brokers, the best course of action is to open an account with a minimum deposit – minus any bonuses. Then after the trading period, contact the broker and negotiate directly with them, based on a larger deposit. This is especially effective if there is a larger amount to invest. The larger the second deposit, the better any bonus mentions.

If that seems like too much trouble, then new traders will certainly research any potential bonus – and make sure it works for them. Make sure any bonus conditions can be met comfortably – without changing any trading habits. Paying particular attention to procurement requirements, and any time constraints within which constraints must be met.

Terms and conditions

There are several issues that traders should be aware of when comparing bonuses. All these issues are usually in the term everywhere, so it is important to check them. Here, we’ll list some details to look for when printing the small print of the bonus deals you find:

- Withdrawal restrictions – Almost every bonus will have this. For example, are there procurement requirements, and do they need to be met within a certain time frame? The bigger the deposit the stricter this will be. A $100 bond that needs to be turned in 20 times, means $2000 worth of trades.

- Is your deposit locked? – There are bonus forms that actually lock the initial deposit, as well as the deposit itself, so that nothing can be withdrawn until the turnover requirements are met. This bonus is very rare – but puts traders at a huge advantage. Any broker that uses this kind of term should be avoided entirely.

- How are bonuses paid? – Is the bonus fund separate from your deposit? If so, this is usually better.

- How are winnings bought with Risk-free trading? – Are profits paid as cash into the account, or added as bonus funds (with their own terms and conditions to be met)

Finding the Best Deals

As we’ve discussed, finding the ‘best’ binary options bonus is a case of discussing terms and conditions. Only then can you judge if the bonus suits your trading style. A big bonus with strict conditions can be worthless if the conditions are not met without causing you to go overboard. A small bonus, with few, if any, restrictions, can be a welcome boost to your trading funds. Biggest isn’t necessarily best when it comes to bonuses.

Finally, a high quality reputable broker will make it easy for you to opt out of the bonus. Some people will even let you cancel the bonus deal part way through. A broker who declines their bonus can be seen as a red flag. if the bonus doesn’t suit you, turn it off.

Why You Don’t Want That Deposit Bonus

Deposit bonuses are a common feature of binary options brokers today, who use them as an enticement to get new traders to open and fund accounts. Who doesn’t want free money but the question is, is it really free? There are several reasons why a bonus is not as easy as it seems and why you don’t want to receive one.

Trade Minimum – Every bonus comes with a trade minimum. This is the dollar amount you must reach before the bonus money can be withdrawn from your account. The minimum is based on your original deposit and bonus so if you deposit $ 2000 and get a 50% bonus the minimum will be based on $ 3000. The average minimum trade will be between 20 and 30 times the value of the entire account. We have seen some as low as 15 times and some as high as 40 or 50 times the total value of the account. This means that an account with a total value of $3000 needs to make trades totaling $45,000 before the bonus becomes yours. I want to sell 1% of my account at a time to make sure no trades can damage my account. In a $3,000 account that means making $30 trades at a time, $45K divided by $30 is 1500 trades. Of course, you can make bigger trades to eliminate the minimum faster but that can also lead to catastrophic losses.

Time Limits – Some, but not all, deposit bonuses have time limits. This is usually something like 30, 60 or 90 days. This means you have to reach the trade minimum before the time limit before you can make a withdrawal. We don’t want to realize that any of you can’t turn $3,000 into $45,000 but consider your chances of doing that in 30 days. You probably don’t like being forced to trade more than your budget or system. Time limits may be another reason to shoot for the stars, trade more often or with higher amounts than usual and add risk to your portfolio.

Withdrawals – Bonuses make withdrawing money from your account difficult. Some brokers, the shadier ones, won’t let you withdraw any money until you meet the minimum trading limit. A broker that will not let you withdraw any part of the bonus or profit based on the bonus. In any clause in these terms will usually cause you to lose all bonuses and all profits with any withdrawal request before meeting the withdrawal requirement. If you trade your account for $3,000 to $10,000 or $15,000, you may want to take a little bit.

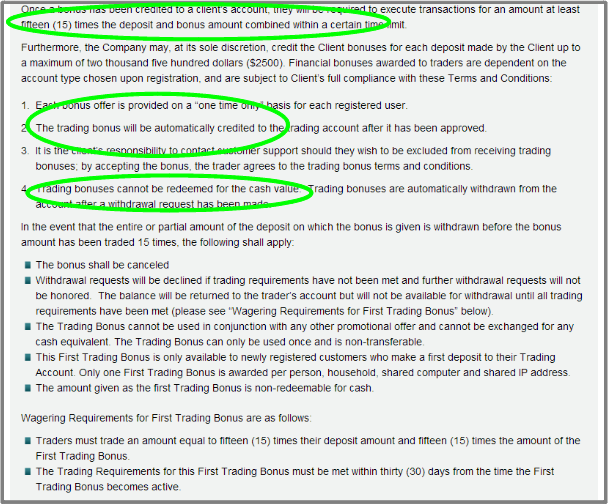

This broker (OptionYard) says that the bonus cannot be redeemed for cash value, very shady.

Free Signup Bonuses – Free signup bonuses of $50 or $20 are not very common these days. This is a “free” bonus you get when you sign up for an account and supposedly requires no deposit. Except that maybe. The only way to get the bonus is to deposit money and then meet the bonus requirements. You can also get an additional deposit bonus on top of the signup bonus, which means the bonus requirements may be quite high. Be sure to check what’s going on with your chosen broker.

There is a reason why brokers continue to use bonuses as an incentive – they know that the average binary options trader is more likely to lose all their money than to eliminate the bonus requirement. That is why the minimum requirements are very high and the time limit is short. To achieve the bare minimum, you will probably engage in risky behavior. Once you contemplate receiving a bonus be sure to read the terms of use and fully understand what is required to clear the minimum. As with everything in life not all brokers are the same and each will have different policies regarding bonuses and when and even if the bonus is really yours.

Bonuses are often applied to accounts automatically by the broker as soon as they are funded so be careful with this see if you can decline the bonus, if you want, before you do. To withdraw you, the merchant, are responsible for contacting their account representative. Some brokers will also offer other bonuses from time to time so be sure to read the terms and conditions before accepting them.

Risk In “Risk Free” Bonus

There are hidden risks to free trade risks the average binary options trader is unaware of. Fortunately we can reveal what to look out for.

There are some obvious advantages to using risk-free trading, you will never lose, but the truth is that there are still some disadvantages to the equation that might make you think twice about using it. Following that you will find an explanation of some of the types of offers you can find and why they are not risk “free” as advertised.

$50 Bonus Offer Or No Deposit Bonus

Some brokers will give you $50 free to start trading. This sounds great and is a potential way for a trader to leverage a broker for demo trading purposes. Of course, $50 should be enough to make a trade or two.

To speed up the deal some brokers will also tell you that it is possible to withdraw $50 once you meet the minimum requirements and trading volume. This is not common in and of itself, bonuses come with terms. But be careful with the related “tie in”. A minimum deposit is a requirement to unlock withdrawals and this is true for “No Deposit Bonuses”. Sure you can get it. Sure you can withdraw it, but only after making a deposit. The deposit may also need to be more than the original bonus.

Free Demo Or Free Trade Risk

Some brokers offer free demos to potential clients with just an email address in return. It’s not something to worry about, it’s fine for them to want to get your email in return for a free service.

What’s not OK is advertising a free demo and then requiring a deposit to get it, that’s a bait and switch. This demo is free, if you deposit us. What’s worse is that most brokers who use this tactic are not giving you a demo account, they are dealing with a “demo bonus” on top of your deposit and all the trimmings that go with it; minimum quantity and complicated production requirements. We don’t list brokers that operate like this, but it’s worth noting.

Cash Rebate Program

A cash rebate program sounds great right? This usually requires a certain minimum deposit, a certain minimum maintenance balance and trading volume. But here’s what you need to know – Some rebate programs give you money just for your losses.

If you are a net loser during the month you will get back part of your losses, if you are a net winner, you will not get anything back. The kicker is if you are a net loser, you have to make another deposit to maintain your balance requirement (where there is one). Some rebates don’t require a minimum balance, you have to lose all your money to get them.

Also remember that rebates are often paid as bonus funds – with their own set of terms. So they are often not so interesting after all.

Risk Free Trading

The worst of the risk-free deals is the out-and-out risk-free trade. Some brokers will offer you risk free on the first, second and third trades. This will always come with a minimum deposit and usually an automatic bonus.