Trading ladder options is quite similar to border (or range) options. While in border options two limits are provided – one upper limit and one lower limit , with ladder options, there are usually five price limits (the exact number will change depending on the broker and the asset). This limit is not always symmetrically distributed to the current price level.

This means that all five limits can be below the current price level or 3 limits can be higher than the current price level and 2 can be lower, for example. Limits are usually traded in both up and down directions – but not necessarily. All price limits have two options to trade with – ‘ Above ‘ or ‘ Below ‘ (may be represented as ‘Call’ or ‘Put’ by some binary options brokers). Each limit will have a different payout percentage for ‘Above’ and ‘Below’ options.

This percentage depends on the probability of an ‘in the money’ (correct) finish prediction. If the probability of the prediction being true is high, the percentage payment will be small and vice versa. This is how ladder options can produce payouts that reach 1000% and above, the high payouts reflecting the low probability of them finishing in the money. Limits – or ‘rungs’ – are defined by the broker and cannot be changed. However, the end time can be changed. When the expiration time is amended, there is a corresponding change in the limits and potential payouts.

Ladder options – Examples

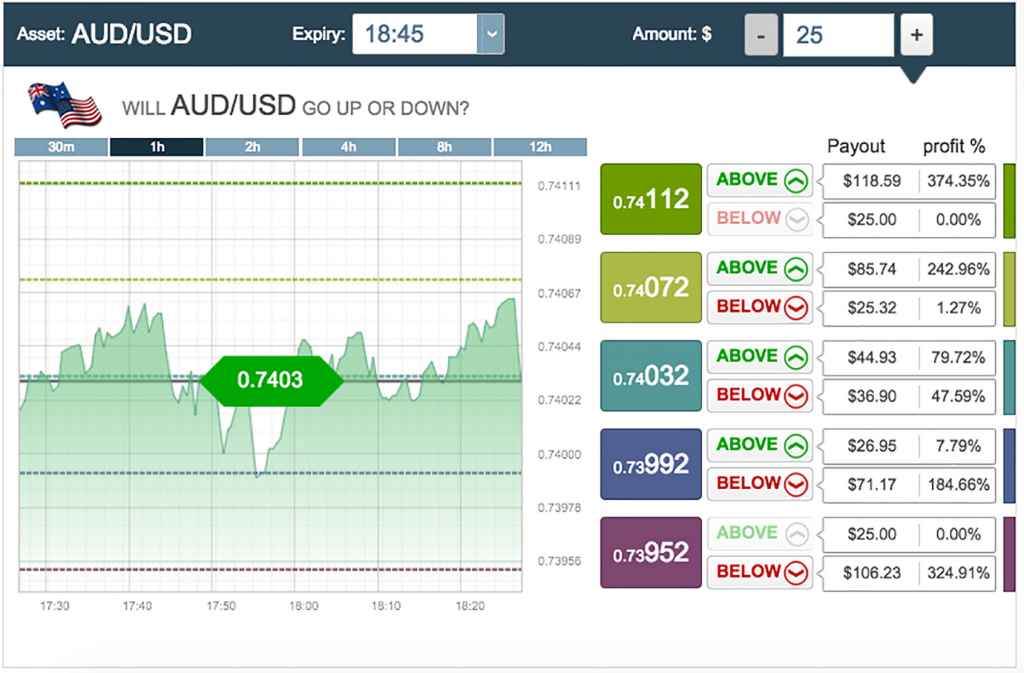

See the screenshot below. On the right are various values – each with a ‘Above’ and ‘Below’ payment number respectively. The payment amount is relative to the $25 entered in the amount field. Each ‘rung’ on the ladder is a different value, and each requires a certain price movement from the actual asset price.

The larger the price step required, the larger the payout. In the image, AUD/USD is trading at 0.7403. If you expect a big price increase, you can pick “above” at the 0.74112 level and get a whopping 374% if you are right.

The mid-level option, has a payout of 47% for ‘under’ and 79% for ‘over’. The options at the top and bottom have only one option available – above at the highest point, and below at the lowest. Brokers think other outcomes are so possible, they are not willing to sell them at all.

The mid-level option, has a payout of 47% for ‘under’ and 79% for ‘over’. The options at the top and bottom have only one option available – above at the highest point, and below at the lowest. Brokers think other outcomes are so possible, they are not willing to sell them at all.

Why Trade Farm Options?

One of the attractions of binary options, is simplicity. Some traders may argue that the ladder option introduces a layer of complexity that moves away from ‘ease of use’ and should therefore be avoided. That view misses several key points;

- Ladder options offer some big payouts, compared to other types of trading

- Ladders provide options during volatile market times

- Where traders expect large price swings, ladders provide higher profits than standard binary options

- Ladders are essentially no more complicated than traditional options

- High frequency, low risk / low payout trades can be done with ladders.

The last point is worth expanding on. In the screenshot above, the 0.73992 price level can be traded above for 7.79% – Not a huge payout, but if a trader is confident that a move above this resistance level is warranted, it’s a quick, low-risk path to profit.

Farm Trade Wins

Choosing a trading ladder requires market awareness and some research. As with other trading styles, these factors are especially important for ladder trading. It is possible to win the biggest payout only if one can get a correct prediction which has a low probability . A steep rise/fall is required for correct extreme prediction. This may happen if some important event related to the asset occurs.

Interest rate announcements or profit warnings from large firms for example, can cause large and sudden price corrections. Traders need to stay on top of all events to win high paying trades. Likewise, high frequency trading for lower fees depends on reduced volatility. A higher strike rate is required meaning mistakes must be few and far between. Binary options ride offers another path for a trader to profit, but they need to be fully understood. They can be used as hedging tools or specialized in, in their own right.

Never will a binary options broker offer a ladder – prices and payouts need to be constantly updated. Therefore, choose any potential broker wisely, and if the ladder looks like an attractive path to profit, make sure the right broker is chosen.

Ladder Option Strategy

Ladder options offer the highest payouts of all types of binary options. To trade effectively, you need a good strategy. This article introduces you to three great strategies for ladder selection. The three strategies you will learn in this article are:

- Trade levels based on ATR & moving average crossings

- Using ATR & ADX to make negative predictions

- Trade resistance and support levels with ladder options

With these three strategies, you will discover three very different approaches to ladder selection. By understanding the spectrum of possibilities, you learn to adapt our strategy to your preferences and create the ideal strategy for you.

Strategy 1: Trade Range With ATR And Moving Average

When you buy a ladder option, you face two challenges:

- Predicting market direction, and

- Predict various markets.

Overcoming both challenges with the same tool is difficult. This is why this strategy uses two tools – one for each prediction.

Predicting market direction with moving averages

Moving average crosses are perfect for predicting market direction. Moving averages calculate the average price of the past period and repeat this process for all periods in your chart. They then draw the results directly into the chart, which produces a line. This line moves slower than the market:

- When the market is in an uptrend, the moving average will be based on periods lower than the current market price. The moving average will be higher than the market as well.

- When the market is in a downtrend, the moving average will be based on a period higher than the current market price. The moving average will be higher than the market as well.

When the market changes direction, it goes from being on one side of the moving average to the other, which means that it has to cross the moving average. As a result, the market spread of the moving average is an important event that signals a change in market direction. This is the perfect event for our strategy.

- When the market crosses the moving average, invest in ladder options that predict price increases.

- When the market crosses a downward moving average, invest in a ladder option that predicts the price will fall.

Now that you have a direction, you just need to predict the range of potential markets. This is why you need an ATR.

Predict various markets with ATR

Average Universal Range (ATR) is a volatility indicator. It measures the actual average distance the market has moved each period in the past. Let’s use an example from our basic text on ladder selection. Assume that you are trading the AUD vs JPY currency pair with a current price of 91.226.

The end of your ladder selection is 1 hour. ATR has a value of 0.1 on the 10-minute chart, which tells you that the asset has moved an average of 0.05 over the past period.

This value allows you to predict how far the market can move and the target price you should use for your ladder option. Let’s assume that the asset just crossed your moving average upwards and you want to invest in the price increase. Your broker offers a target price for your ladder option:

| Name | Price limit | Above Payment | Under Payment |

| Price Level 1 | 91,200 | 54.23% | 92.62% |

| Price Level 2 | 91.245 | 90.89% | 55.44% |

| Price Level 3 | 91.291 | 158.29% | 31.47% |

| Price Level 4 | 91.337 | 280.34% | 11.32% |

| Price Level 5 | 91.382 | 530.43% | 1.00% |

| Price Level 6 | 91.425 | 1011.23% | 0.00% |

Which of the target prices is the best option for ladder options? Let’s go through them one by one.

- Price level 1 (91.2) is lower than the current market price (91.226). Since you are predicting an upward movement, this would be a very safe prediction. However, it also limits your payout to 54.23 percent. This is not profitable enough.

- Price level 2 (91.245) is above the current market price (91.226), but not by much. In a market that moves at a speed of 0.05 per period, it will take the market less than one period to reach this price. Since you expect an upward move, this is still a very safe prediction. It will give you a payout of 90.89 percent, which is better than price level one, but it’s still not much.

- Price level 3 (91.291) is about 1.5 times the ATR value (0.05) from the current market price (91.226). This sounds interesting. Remember: to win your choice of stairs; the market is forced to trade above the target price one hour from now. You have six periods until this happens (60 minute expiration, 10 minute chart). Not all dot points move in the same direction, which is why the market is unlikely to reach the target price six times as far as the ATR value. But a target price in the range of 1.5 times the ATR value with a payout of 158.29 percent seems like a relatively safe bet to make a nice profit.

- Price level 4 (91.337) is slightly more than twice the ATR value of the current market price (91.226). In an upward movement, the market can still reach this target price. This prediction is slightly riskier than price level 3, but it gives you almost double the payout – 280.34 percent. Most traders prefer this investment.

- Price level 5 (91.382) is slightly more than three times the ATR value of the current market price (91.226). This is a risky prediction. The market should move in the right direction for four of the five periods. If you’re right, you’ll get a crazy payout of 530.43 percent, which means winning a quarter of your trades will still be profitable for you. Risk takers prefer this target price.

- Price level 6 (91.425) is more than four times the ATR value of the current market price (91.226). This prediction is too risky. Although you will get a payout of 1011.23 percent, there is almost no market chance of reaching this target. It should move in the right direction for one hour. Stay away from this prediction.

With this evaluation, ATR has helped you distinguish the target price.

- If you like to play it safe, use price level 3.

- If you like to take risks, use price level 5.

- Traders looking for a good mix of risk and potential take price level 4.

Trade this strategy for a while and monitor your success. You will find that you prefer a certain price target price ratio and ATR. In our example, the ATR has a value of 0.05 and there are six periods until the option expires.

If all periods point in the same direction, the market will move around 0.3. Some traders like a target price that is about half this distance from the current market price.

They will invest at price level 5. Other traders may prefer a target price that is one third of this distance, which will lead them to invest at price level 3. Find your own perfect ratio, and you will be able to quickly and easily use ATR to choose the right price level for your stair choice.

Strategy 2: Using ATR & The ADX

In our previous example, we used ATR to make positive guarantees – we predicted the price level that the current movement could reach. With this strategy, we want to do the opposite: we want to predict which price levels are outside the range of the current movement.

We can achieve this without moving averages. No signal needed; we just want to know if the price level is out of reach. On the other hand, we need less precision, therefore we need the average directional movement index (ADX). Let’s use the same example as before: you are looking at a 10-minute chart of the currency pair AUD vs JPY with a current price of 91.226. Your broker offers target prices for ladder options with 60-minute expirations:

| Name | Price limit | Above Payment | Under Payment |

| Price Level 1 | 91,200 | 54.23% | 92.62% |

| Price Level 2 | 91.245 | 90.89% | 55.44% |

| Price Level 3 | 91.291 | 158.29% | 31.47% |

| Price Level 4 | 91.337 | 280.34% | 11.32% |

| Price Level 5 | 91.382 | 530.43% | 1.00% |

| Price Level 6 | 91.425 | 1011.23% | 0.00% |

Since we are now making a negative forecast, we need to focus on the payout below. The important question is what price level the market can reach and at what price level it makes sense to invest. Let’s take a look at each price level:

- Price level 1 (91.200) is below the current market price (91.226). This is a bad investment. When you get a payout like this, your broker expects the market to move up. Otherwise, they will not offer high payouts for predictions below. Therefore, it does not make sense to invest in falling prices.

- Price level 2 (91.245) is above the current market price (91.226), but not by much. Predicting that the market will trade below this price level only makes sense when the ATR has a very low reading, eg01. Anything else, and this prediction is too risky. With a payout of 55.44 percent, you need to win more than 65 percent of your trades, so this price level is not worth the risk.

- Price level 3 (91.291) is further away from the current market price (91.226) but still very close. This price level will be a possible investment if the ATR value is very low, for example02. The payout of 31.47 percent is attractive for a negative prediction, but you need to know that you are making a safe prediction here.

- Price level 4 (91.337) allows you to make safe predictions in most market environments. Even if the ATR reads 0.3, the market may not trade above this price level when your option expires. Some traders will also trade this value with an ATR of 0.4, but the relatively low payout of 11.32 percent requires you to make safe predictions that can win a high percentage of your trades.

- Level 5 and 6 prices (91.382 and 91.425) pay a payout of 1 percent and 0 percent, respectively. There is no sense in such a payment trade.

This point is difficult to choose the perfect price level based on ATR alone. In most market environments, you can safely sell price levels five and six, but their low payouts make these price levels unprofitable. All other price levels require you to combine risk and potential. To figure out how to mix these factors, you need another tool.

This tool is the Average Directional Moving Index (ADX). ADX rates the strength of market direction on a scale of 0 to 100. Most traders interpret a reading below 20 as a lack of direction and a reading above 40 as a strong direction. These values help you to estimate the target price you should use for your ladder selection:

- If the ADX reads more than 40, be careful. When the market has a strong direction, you need to plan for the worst. Assume that all the periods before your option expire in the same direction and choose the price level with the highest payout outside this range. In our example, there are six periods until your option expires. Price level 3 (91.291), for example, is 0.65 from the current market price (91.226). When the ATR is read less than 0.1, this is the price level to choose.

- If the ADX reads less than 20, go for it. When the market has no direction, it’s time to get a high payout. Risk takers may even invest at a price level that is only as far as the ATR reading from the current market price, traders with moderate risk tolerance should use a target price that is twice as far as the ATR reading. In our example, this means that the risk taker can even invest at price level 2 when the ATR reads 0.05, which is a relatively high value. All others should decide between price level 3 and 4. When ATR has a lower reading, all traders can choose price level 2.

- If ADX is read between 20 and 40, take moderate risk. When the market has moderate directional strength, your risk should also be moderate. Choose an approach between the two examples above. When the ATR reads 0.02, for example, most traders will invest at price level three, which is a safe prediction but still gets a payout of 31.47 percent.

You can also exclude one or two market environments from your strategy. Risky traders may only invest in this strategy when the ADX reads less than 20.

Strategy 3: Trade Resistance / Support With Ladder Options

This strategy is suitable for traders who like visual signals more than mathematical calculations. Resistance and support levels are important price levels that the price of an asset cannot break. For example, assume that an asset has been trading around £99. It has tested the £100 barrier several times but has always failed to break it. In this case, the £100 barrier becomes the resistance.

Similarly, when the asset has traded around £101 but failed to fall below £100, the £100 barrier becomes a support level. In both cases, there is something that prevents the asset from breaking the wall of £ 100. You will not know what exactly stops the market, but this is not important. It appears that traders are no longer willing to buy (in the case of resistance) or sell (in the case of support) the asset for £100.

This is all you need to trade ladder options. When the market approaches the resistance line, you wait until the first target price with a reasonable payout comes into range. Your definition of a reasonable payment is up to you. Most traders want at least a 30 percent, preferably 50 percent payout before they invest.

If the market moves close to resistance/support, you may be able to invest in the same resistance/support with a higher payout. Most traders will use this opportunity to make more money with the same forecast. If the market breaks resistance or support, you will lose all your options. You can make up that lost money. When the market breaks resistance/support, it has freed itself and is likely to move strongly.

This is an ideal environment to invest in ladder options that predict a strong move. You should be able to easily win the ladder option with a payout of 200 percent, which can cover your losses.

Scope – Summary

Ladder options allow for a variety of potential strategies. Depending on your risk tolerance and whether you prefer positive or negative forecasts, you will need to adjust your strategy along the lines of the three strategies we have described. The possibilities are endless, but now you know where to start.