Heiken Ashi Strategy – Japanese Samurai Art

Believe it or not, successful traders have the mindset of a Samurai, a legendary Japanese warrior. Our Heiken Ashi strategy comes from Samurai culture as it follows the same principles that guided the Japanese Samurai.

Our team at Trading Strategy G uides believes that the Samurai code of honor, known as Bushido, which means warrior, has superior principles that can be extrapolated and applied to trading in any market. Like a warrior, you have to be disciplined and pay attention to the situation in front of you.

One of the unwritten rules of Samurai conduct explicitly states that a Samurai is never afraid to act. A Samurai lives fully and magnificently. Our Heiken Ashi PDF trading system will instill the confidence you need to trade successfully and overcome trading fears.

The Heiken-Ashi technique is just another way of looking at charts that traders can use to open trading opportunities. A revolutionary new way of looking at charts that can be used on any time frame.

Regardless of your trading style (day trading, swing trading, trend following), you can implement these trading methods to make better decisions. We also recommend learning how to identify the right swings to increase your profits.

First, let’s understand the Heiken Ashi charting technique. Then we will outline the rules of the Heiken Ashi PDF trading system.

Another benefit is that we will highlight some real trading examples to better understand the best Heiken Ashi PDF strategy.

What is the Heiken Ashi Technique?

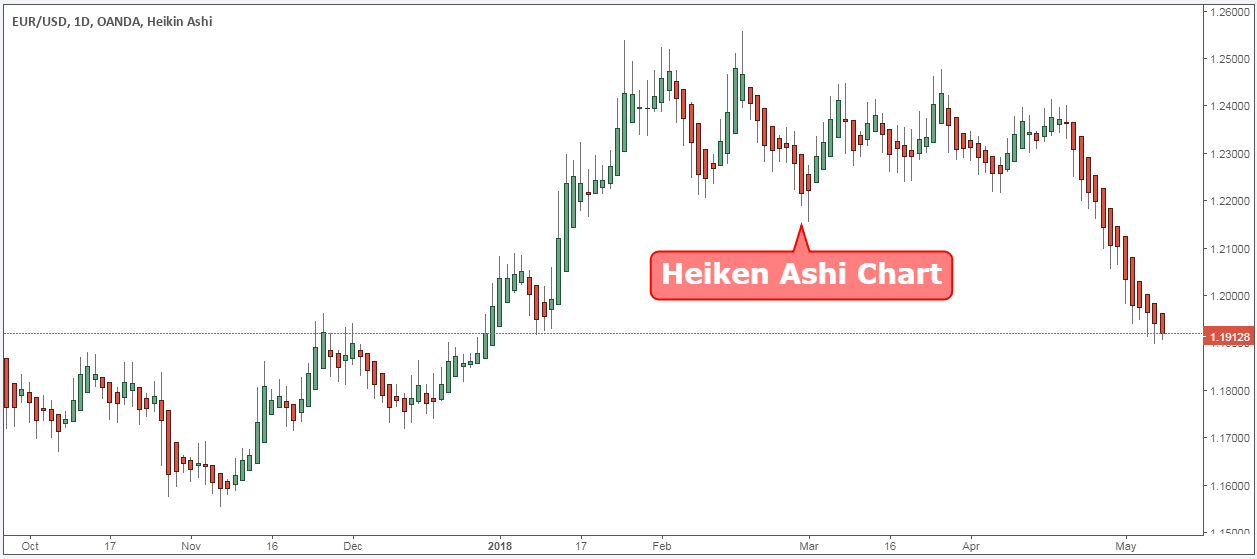

The three most used price settings are bar charts, candlestick charts, and line charts. And then there are other less used charting techniques, such as the Heiken Ashi. The Heiken Ashi chart provides an in-depth view of the market. Use it when making trades that require accurate entry and exit.

The Heiken Ashi is a charting technique that can be used to read price action and predict future prices. This is similar to a traditional leather candlestick chart. Unlike candlestick charts, Heiken Ashi charts try to filter out some of the market noise in an effort to better capture market trends.

In short, Heiken Ashi is a different way of displaying prices on our charts.

Here is a typical EUR/USD candlestick chart:

In Japan, Heiken Ashi means “Average Bar” and it represents the average price, or price rate.

The Heiken Ashi candlestick chart helps you see trading periods and timeframes to avoid.

Here is the same EUR/USD chart, but once the Heiken – Ashi chart is used:

As we can see, there is a significant difference between the two types of charts. That’s because Heiken Ashi candlesticks use a complicated mathematical formula to determine the OHLC price.

The good news is that you don’t need to be a mathematician to trade the best Heiken Ashi PDF strategies. All you need to do is understand the principles.

There are two main trading signals that we can recognize through Heiken Ashi candlesticks:

- Candlesticks that stand out have no wicks or very small wicks. They show a strong uptrend and an excellent buying opportunity.

- Small candles are characterized by a small body, a large top, and a lower stem. They signal a possible reversal.

Now, here’s the best way to conquer the market using the Heiken Ashi PDF trading system:

The Best Heiken Ashi PDF Strategy

The best Heiken Ashi PDF strategy can only help you as long as you apply strict risk management methods. Now you know what Heiken Ashi candles are and how they differ from regular price candles. Let’s see how they can benefit traditional price candles.

Heikin-Ashi Candles use three data sets based on open and close.

- Price data from the closing low to the current open low.

- Current Heikin-Ashi value.

- Previous Heikin-Ashi values.

Now, before we go any further, we always recommend getting a piece of paper and a pen. Pay attention to this method of participation.

The Heiken Ashi Technique Formula

If you want to use the Heiken Ashi technique, you will probably use trading software that can create charts for you. Because of this, memorizing the Heiken Ashi chart formula may not be necessary. However, knowing the formula can help you understand why this technique is useful.

Heiken Ashi uses the COHL formula, which stands for “Close, Open, High, Low.” These are the four components that affect the shape, size, and direction of the bar. The formulas for each of these components are listed below:

- Close (shows the average price) = (Close + Open + High + Low) / 4

- Open (indicates the average of previous bars) = (Previous Open + Previous Close) / 2

- High (highest value) = recent high, open, and close high

- Low (lowest value) = the lowest value of the new low, open, and close

Once each of these variables has been recognized, you will be able to create a Heiken Ashi chart. Sometimes, some of these values will be the same, which will affect the overall appearance of the chart. Adjusting the time period will also have a big impact on the shape of the graph. Many day traders prefer to use the five-minute Heiken Ashi trading strategy. But using a time period of 15 minutes, hourly, or even daily is also possible.

For this article, we will look at the buying part.

Step #1: Identify a strong move to the bottom.

What we will see now are some ways we can combine this Heiken Ashi candle with our traditional technical analysis and start looking for some specific trading ideas.

One of the simple ways we can use Heiken Ashi candlesticks is to trade reversals when the candle changes color.

First, we will look for a strong downtrend or downward movement.

Note * Heiken Ashi charts tend to give more price spikes more flexible and smooth price spikes. This is because of how the calculation is used to flatten the bar range.

In the EUR/USD chart above, we have a double bottom, which is a classic technical setup.

These two levels have almost reached the same level. This is a traditional bullish reversal signal.

The Heiken Ashi strategy needs to follow one more condition before pulling the trigger.

Step #2: Wait for the Heiken Ashi bar to change color from bearish (red) to bullish (green)

The first sign that the price is going higher is when we see a green Heiken Ashi candle.

For the Heiken Ashi bar to change color, there must be a strong shift in the order flow. This usually translates into a much more reliable signal than what we get when the price of a normal candle changes color on a normal price chart. When the color changes, it may be time to make a trade.

The way we use this feature is simply to perform traditional technical analysis and find potential reversal zones with Heiken Ashi charts.

We use price action reading skills as a filter to identify potential trades. Then we use the Heiken Ashi chart as a confirmation to go ahead and execute the trade.

Step #3: The first bullish Heiken Ashi candle should have a larger than average upper wick

The upper upper wick (upper shadow) can provide exceptional trading signals. Especially when using the Heiken Ashi price chart.

You can also wait until you see an ascending Heiken Ashi candle with no lower wick. However, this approach will cost some profit on the table.

The Heiken Ashi trading strategy caters to all trading conditions. This means we can move forward and outline the trigger conditions for our entry strategy.

See below:

Step #4: Buy in the market at the opening of the next Heiken Ashi candle

Our entry method is very simple.

This is a bullish reversal setup, so we look for buying opportunities once everything is in place.

Now we can expect that the reversal will take place. We can go ahead and buy EUR/USD at the opening of the next Heiken Ashi candle.

This brings us to the key points we need to make for the best Heiken Ashi PDF strategy. Where do we place our protective stop loss?

See below:

Step #5: Hide your protective Stop Loss below the low of the first bullish candle.

One of the really great things about Heiken Ashi candles, and what makes them so great to trade, is how we can use them to place our protective stop loss.

Because of the candle’s tendency to display continuity, we can continue to advance and become very close to our stops. We can place a stop loss below the low signal candle.

Finally, we also need to determine where to take profits.

See below:

Step #6: Take profit after we get a close below the previous bullish candle.

A good Heiken Ashi trade setup will tend to last longer than a normal price action setup. When we trade Heiken Ashi candles, we really want to exploit this. It is important to keep our trade longer than usual.

Because we are using a tight stop loss, we will only need a small price movement to make a good profit on this trade.

Note ** above is an example of a BUY trade using our Heiken Ashi PDF trading system. Use the same rules for SELL trades – but in reverse. In the picture below, you can see an example of a real SELL trade.