Do you want to learn cryptocurrency day trading and make $500 per day consistently? We often hear about all the money you can make by day trading stocks. But what about crypto day trading? In today’s lesson, you will learn how to day trade cryptocurrencies using our favorite crypto analysis tool.

Our team at Trading Strategy Traders is fortunate to have more than 50 years of combined trading experience today. We will share with you what it takes to day trade for a living, and hopefully, at the end of this trading guide, you will know if you have what it takes to succeed in this business.

First of all, when day trading, it is important to have a structured approach and a rules-based strategy. Just like swing trading or position trading you will not trade every day, and you will not make money every day. Therefore, you need a cryptocurrency day trading strategy to protect your balance.

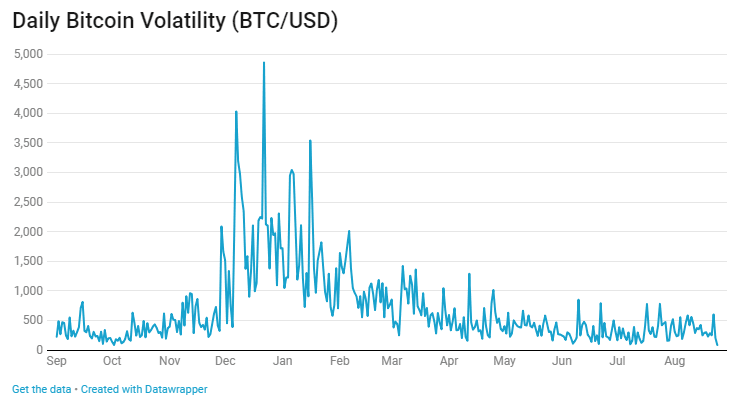

The high volatility nature of Bitcoin and other cryptocurrencies has made the crypto market like a roller-coaster. This is the perfect environment for day trading because during the day you will have enough swings and drops to make a good profit.

Moving forward, we will teach you what you need to learn how to day trade cryptocurrencies and we will share some rules-based day trading strategies.

How To Day Trade Cryptocurrency

The unique characteristics of the crypto market require you to have a solid understanding of how it works. Otherwise, your experience can be like skydiving without a parachute.

The good news is that we will give you everything you need to survive in crypto day trading.

Day trading the cryptocurrency market can be a very lucrative business because of the high volatility. Since the crypto market is a relatively new asset class, it has led to significant price changes.

Before day trading Bitcoin or any other altcoin, it is prudent to wait until we have a high volatility reading. The good news is that even though we have low volatility readings compared to other asset classes, this volatility is still high enough that you can make modest profits on your trades.

Crypto day trading also requires good timing and good liquidity to make the right entry.

Many cryptocurrencies and crypto exchanges are very liquid and do not have the liquidity to offer the instant execution that you may find when trading Forex currencies.

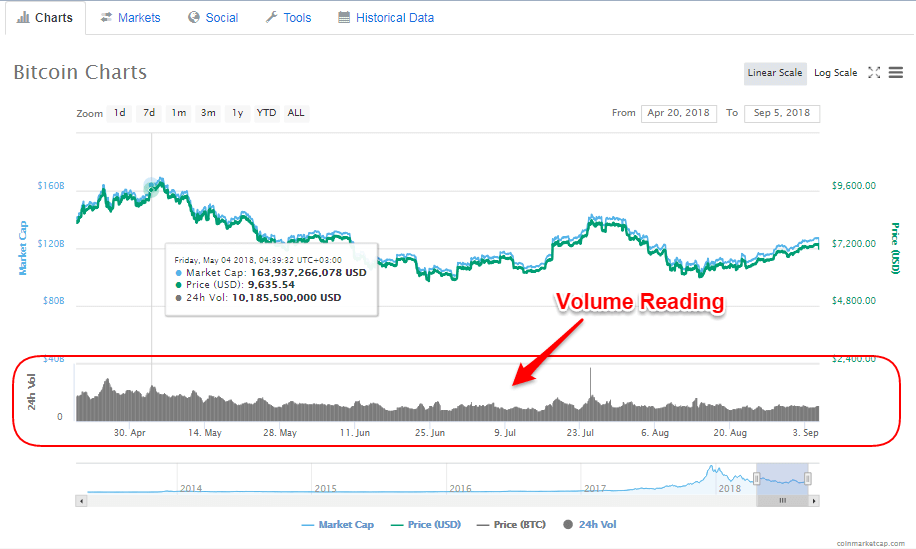

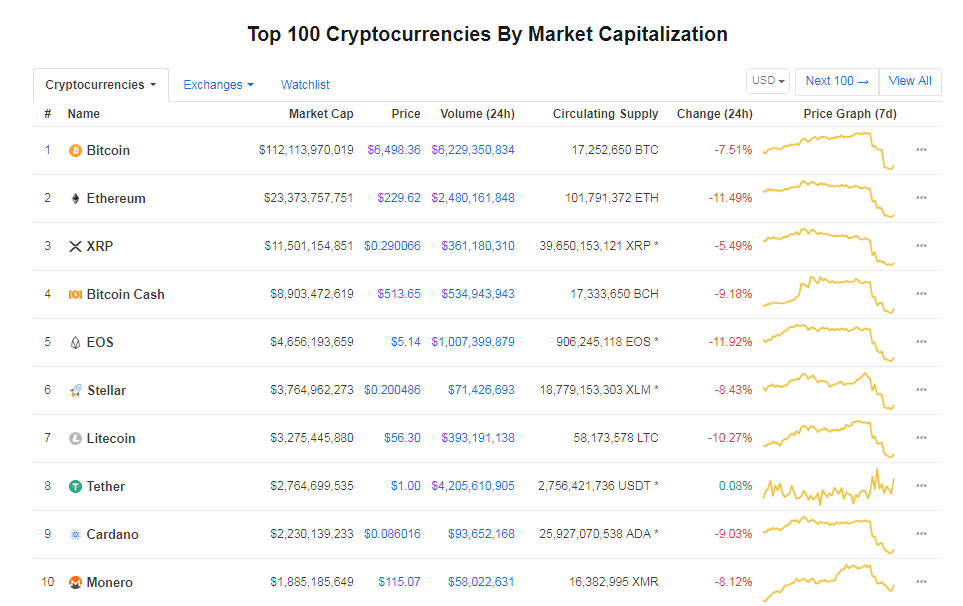

Before day trading Bitcoin or any other coin, it is also important to check how liquid the cryptocurrency you want to trade is. You can do it by simply verifying the 24-hour crypto trading volume.

CoinMarketCap is a good independent resource for reading and measuring the market volume of any given coin.

Note * Always keep in mind that not having enough liquidity can lead to big declines and then bigger losses.

As mentioned earlier, crypto day trading does not require trading every day. We only love cryptocurrencies the day when all the circumstances align with us. In this case, avoid trading on weekends and limit trading only on the highest volume days.

Fasten your seat belts because next, we will reveal how professional traders are daily cryptocurrency.

Crypto Day Trading Strategy

The idea behind crypto day trading is to find trading opportunities that offer the potential to make quick profits. If day trading suits your own personality, let’s dive in and go through a step-by-step guide on how to day trade cryptocurrency.

Now, before we go any further, we always recommend taking a piece of paper and a pen and pay attention to the rules of this scalping strategy.

In this article, we will look at the ‘buy’ section.

Step #1: Pick a coin with High Volatility and High Liquidity

As previously discussed, the number one choice you need to make is to choose a coin that has high volatility and high liquidity. If you are not day trading Bitcoin, which is the most liquid coin out there, and you like altcoins, try to choose coins that have good liquidity and volatility.

There are more than 1600 coins on the market and growing. By following only the major cryptocurrencies, you will narrow down your selection area.

Small cryptocurrency day trading can also be a very profitable business, but there is a higher risk involved. Remember, crypto prices can fall momentarily when they have risen.

Moving forward, you will learn how you can day trade cryptocurrencies.

Step #2: Use the Money Flow Index Indicator on the 5-Minute Chart

Today’s trading strategy uses a simple technical indicator, the Money Flow Index. We use this indicator to track smart money activity and measure when institutions buy and sell cryptocurrencies.

The preferred setting for the MFI indicator is 3 periods.

We will also change the default buy and sell levels from 80 to 100 and from 20 to 0 respectively.

How to use the IMF indicator will be outlined during the next step.

See below:

Step #3: Wait for the Money Flow Index to reach the 100 level

An MFI reading of 100 indicates the presence of a large shark stepping into the market. When buying, smart money can’t hide their footprints. They cannot leave a track of their activity in the market and we can read that activity through the MFI indicator.

Technical indicators are not always correct, so to refine today’s trading strategy, we have added a few more conditions. That is, during the day, we need to skip the first two MFI readings of 100 and study the crypt price reaction.

The price should hold during the first and second 100 MFI readings.

If the price falls after the first two readings of the 100 MFI, then this indicates that we are likely to have a down day.

Now let’s determine the right place to buy Bitcoin and what are the technical conditions that need to be met.

Step #4: Buy if MFI = 100 and if the next candle is bullish

We can now wait for the third MFI reading above 100. It doesn’t have to be the third MFI = 100 reading, you can take every other MFI = 100 reading. If your timing does not allow you to capture the third 100 reading on the MFI indicator, you can simply select the next one as long as all other technical conditions are met.

Next, we also need the candlestick when we get the MFI = 100 reading to be a bullish candle. The cap of this candle should be at the top end, giving us a candle with a very small wick.

This brings us to the next important thing that we need to determine when day trading cryptocurrency, which is to place a protective stop loss and where to take profit.

See below:

Step #5: Hide your protective Stop below today’s low. Take profit during the first 60 minutes after you open a trade.

An obvious place to hide your protective stop is below today’s low. A break below that would signal a shift in market sentiment, and it’s best to exit the trade. This can also mark a reversal day.

We are more flexible when it comes to our exit strategy. However, the only rule you have to follow is to take profit within the first 60 minutes or the first hour after your trade is triggered. Holding a trade for more than an hour will result in a lower success rate. At least that’s what our highlighted results show us.

Conclusion – Crypto Day Trading

If you take the time to read the day trading crypto guide, then you should be able to buy and sell Bitcoin and alts and make daily profits. If you are interested in learning how to day trade cryptocurrency, make sure you arm yourself with enough information before diving into the market.

Crypto day trading can be a great way to grow your crypto portfolio and it’s a very profitable alternative to the holding mentality that is paralyzing the crypto community.

Day trading cryptocurrencies can be easier due to the highly volatile nature of the crypto market. The high volatility of day trading is very good, so you have the right environment for success. You may also be interested in reading our guide on the Best Crypto Investments for 2019.

Thank you for reading!

Feel free to leave any comments below, we will read them and will respond.

Also, please give this strategy 5 stars if you enjoy!