Best Scalping Trading Strategy: Simple Scalping Strategy

Thanks for stopping by! We have had many requests for the best scalping trading strategies over the years. We decided to jump on board and give you simple scalping techniques. We think this is the best scalping system you can find. This strategy is called The Triples S or (Simple Scalping Strategy). Triple S is easy to learn. With practice, it will be a great addition to your scalping strategy. It can also be the best scalping method. This strategy is included in our best trading strategies series. We created this series to help traders succeed.

While many of our favorite strategies focus on maximizing the potential for large profits, scalping focuses on finding many small profits in a short amount of time. Rather than focusing on the quality of trades, scalpers are far more concerned with quantity.

What is Scalping?

Scalpers can make thousands of trades in a given trading period. There are three characteristics of scalping strategies: short positions, small profit margins, and high levels of leverage. Scalpers seek to target price gaps and other short-term trading “gaps” that allow them to quickly turn large positions for profit.

To find opportunities for scalping, you need to start by choosing some key technical indicators. These indicators can help you determine when short-term price gaps are likely to occur.

Because scalpers focus on short-term positions with low profit margins, the best scalping strategies (like the Triple S strategy mentioned below) require some leverage. It is recommended that scalpers start with a large amount of capital. Opening and closing larger positions allows you to reduce the marginal cost of trading and maximize profit potential.

The Simple Scalping Strategy is designed solely for scalping. You can try it on a 1-hour or 4-hour time chart. Feel free to try it out and let us know how it works by commenting below!

We think it works best with the 5-minute and 15-minute time charts. You can try this with a 1 minute scalping strategy. But we will focus on the M5 and M15 charts.

This is a very profitable forex scalping strategy that uses very accurate scalping indicators.

A simple scalping strategy using volume indicators coupled with price action analysis.

Let’s discuss this indicator bit by bit, shall we?

What is the Volume indicator for Forex? How does it work?

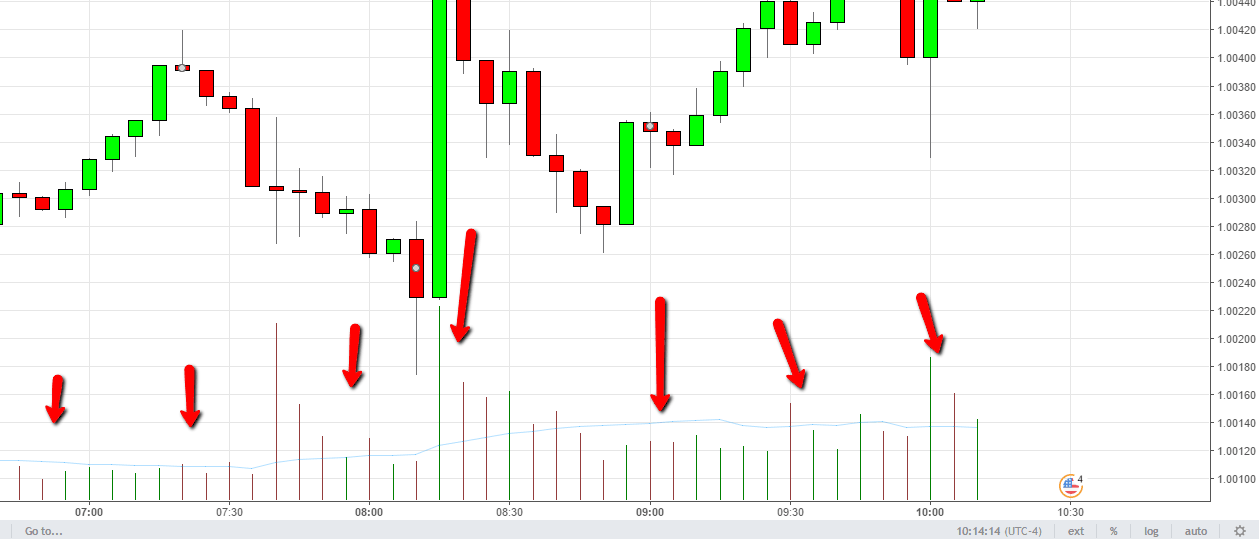

To get started, here’s what it looks like:

The volume indicator can be interpreted as “the oil tank of the main trading machine.” Some argue that the volume indicator should not be used with trading in the forex market. This is because there is no “central exchange” so how can it be read effectively? Another argument is that the number of trades you see for Forex is the number of “Ticks” that occur. This means you don’t see the entire volume of trades being traded at a time like you would with a stock.

The number of flashes is measured by how much the price has marked “up” or “down” in that particular candle bar. Therefore, the more people who enter at that time, the more volume lines will be. This is because there will be more movement in the price action with all the entry orders coming in. So it makes sense that the volume indicator is, firstly, very accurate, and secondly has no real lag. At this time, you show you what price action is doing the number of “ticks” on the candle bar. This causes the bar to look like this:

Scalpers use volume indicators for several reasons. Volume and price have a very strong, short-term relationship, but changes in volume usually precede sustained price movements. Paying attention to the volume indicator makes it possible to take advantage of these moves before they happen.

Using candlestick charts can also help scalpers get a quick view of the market. Candlestick charts contain more information than simple price charts (such as daily price ranges), allowing traders to understand current price trends. Below, we will discuss our one-minute scalping strategy.

One Minute Sharpening Strategy

Scalping is a trading strategy that usually works well using short-term timeframes. Unlike position trading strategies, scalping focuses on making many profitable trades with small margins

Scalping is suitable for day traders and individuals who are able to make important decisions in a short period of time. Usually, you won’t have much time to conduct thorough fundamental and technical analysis while scalping. Movements are constantly changing and prices are constantly being “corrected.”

Whether you’re trading EUR:USD, other currency pairs, or other assets outside of forex, it’s important to pay attention to the details. Scalping usually occurs in 5-20 minute increments. However, if you are trying to implement a one-minute scalping strategy, volume indicators, M5 / M15 time charts, and price action trends should be the first thing you look at.

The key to scalping when using short time frames is to identify price changes before the rest of the market has a chance to act. You should also be prepared to accept very low profit margins—earning less than 1% on a given action will still be in your best interest. Because of this, many scalpers are able to execute strict stop-loss and stop-limit orders from time to time. Also, learn more about the best hedging strategies here.

Triple S Scalping Strategy Rules – The Best Scalping System

Side Note ** Since you are all down to the M5 or M15 time chart price is very sensitive to any and all news. Therefore, I would not use this strategy 30 minutes before and after a major news announcement. To find out if there is a news announcement just check here to confirm!

Method 1: Use the Best scalping strategy indicator: Volume

Any trading system platform is fine because the Volume Indicator comes standard on all trading systems (platforms).

Step 2: Go to M5 or M15 Time Chart

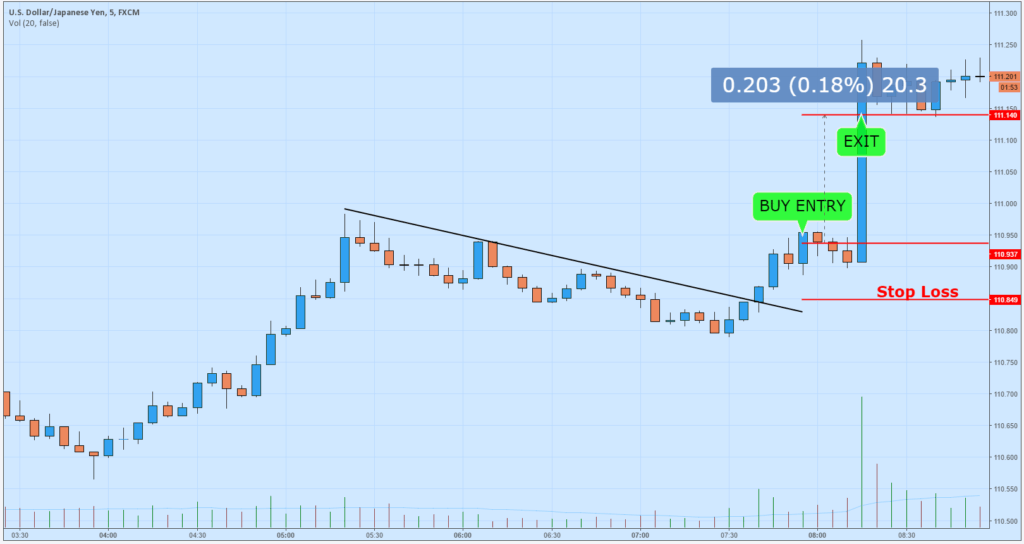

In this M5 time chart, we look at the USDJPY pair.

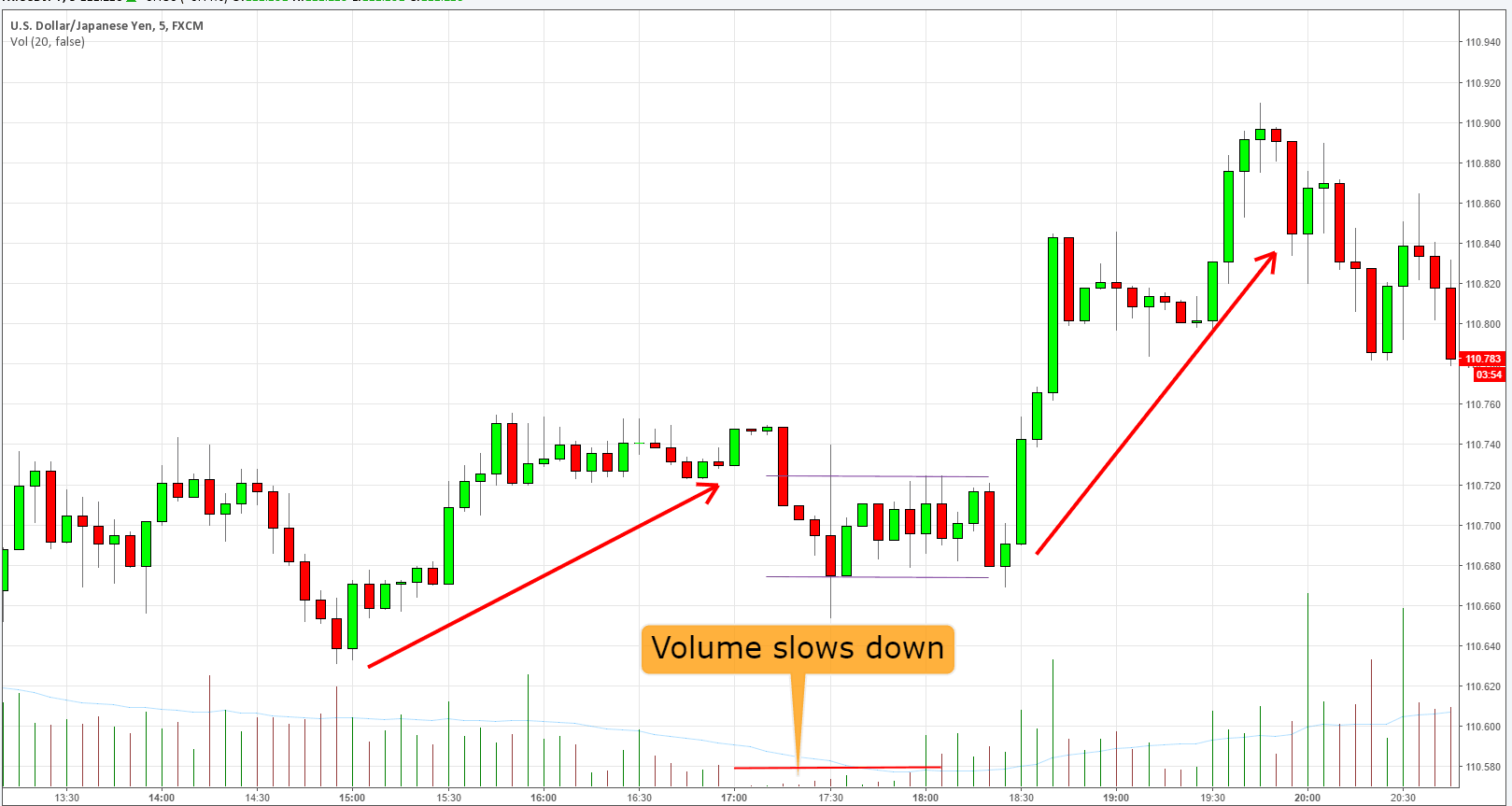

What you want to look for first is if the volume indicator is showing any trends, reversals, or unstable price action. If the volume indicator increases, so does the price action. This is because there is a lot of interest in the currency pair.

As soon as you see a drop in the volume indicator, you know that there are more or less “lice” and therefore less interest in the trend. The strategy we want to focus mainly on is trend trading. You can use the volume indicator for reversal trading. But that’s not something we’re interested in with this strategy.

Step #3 The Best Control System is Analyzing Volume Indicators: Look for a healthy Uptrend or Downtrend. Look for pullbacks in Price action and wait for Volume to Slow down or “Calm down.”

The volume indicator should tell you a large amount of information. If you see a volume indicator do this:

You know that a trend is either:

A. Dead and headed for reversal.

B. Take a break before continuing up.

In this case, it takes a break. There are few buyers and sellers at that time (traders make trading decisions). Then they take it and go straight up. Our strategy takes advantage of this pullback before the price action continues to rise in this example.

So in this analysis step to the strategy you need to check the volume indicator. Based on what you know now, make good trading decisions based on current price action.

Using our example, you should see a steady uptrend followed by a retracement/retracement phase.

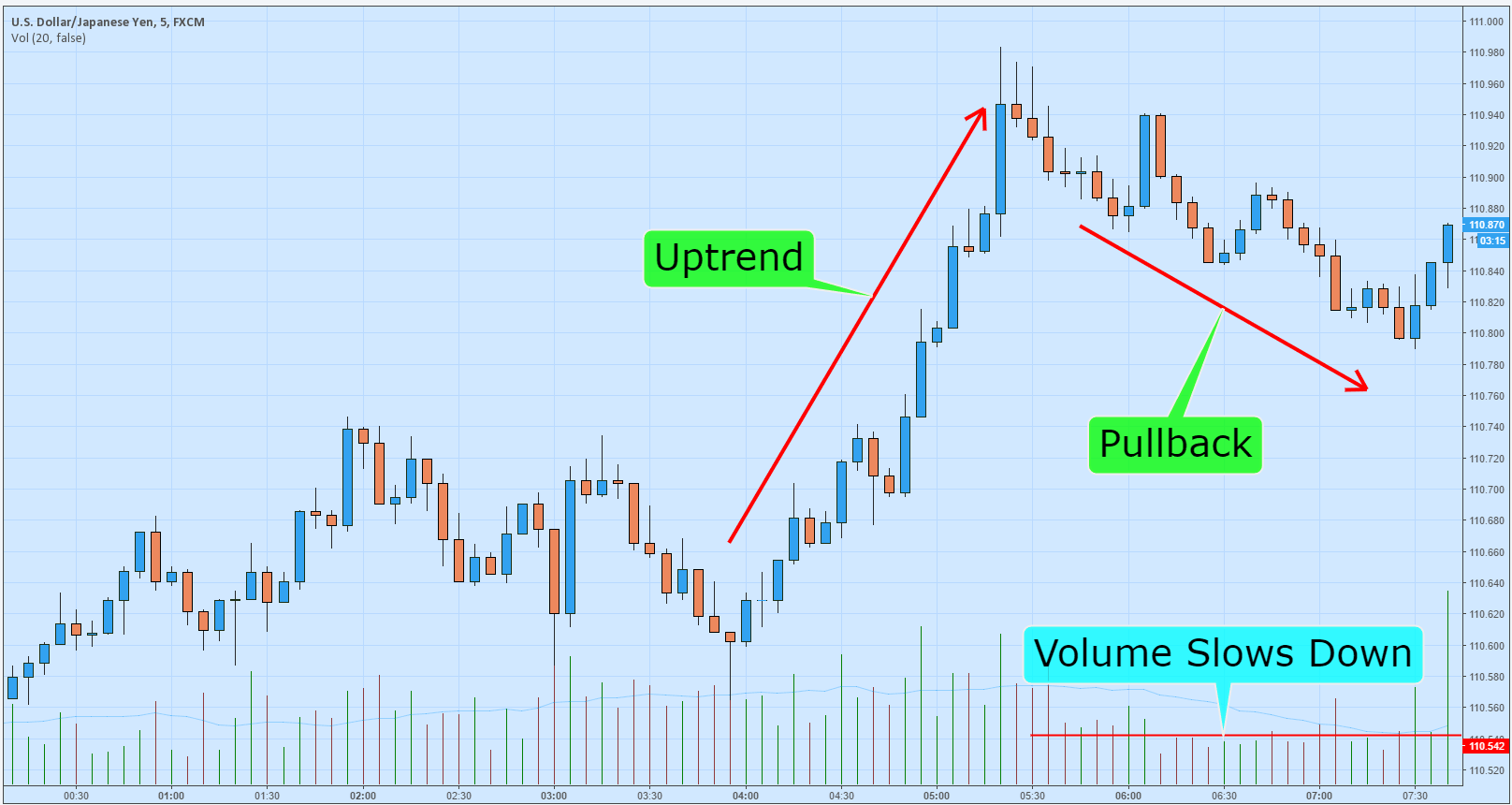

Step # 4 Once you see Volume Rise / Spike (after slowdown) Make Your Trading Decision Based on Current Price Action: Best Scalping System

This part is up to you. There are no “line intersections,” “arrows appear” or “little voices telling you to buy now!” You should understand a little about how price action works before you decide on your entry. Using our example, the Volume indicator drops drastically which means the trader is getting action and thus driving the price up!

Take a look:

Once you see this big spike or see that the volume indicator is showing that there is some action going your way you want to get ready to enter this BUY trade because everything is pointing up.

Entry / Exit Strategy for Simple Scalping Strategy

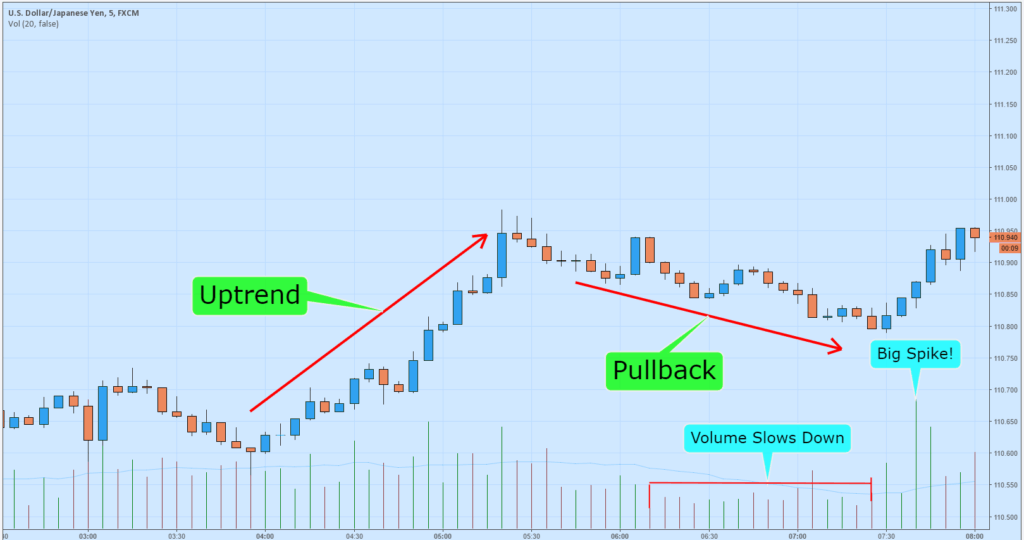

With the current structure of this trade, it makes sense that as we see our “spike” in the volume indicator and it breaks this small retracement trend we pull the trigger and enter the buy!

Your exit strategy is simple. You go for 10-20 pips. Also, You Place a stop stop of 5-8 pips. Once you are up 10 pips move your stop loss up to 5 pips to lock in a small profit (unless the spread is so big that it will most likely break later.)

This 20 pips in less than 5 minutes will not happen every time, but when it does it will definitely make you smile 🙂. The reason we say go for 10-20 pips is for cases like this where you see a big jump after a major trend pullback. You don’t want to go out too early.

Consider this strategy on any major currency pair and you should see some great results!

** The SELL trading rules will be the same, just against your chart. (IE doesn’t start with an uptrend first it will be a downtrend instead)

Other Technical Indicators for Stripping Strategies

As you can see, our Simple Classification Strategy uses volume indicators and candlestick charts. We developed this strategy knowing that this indicator gives traders the tools they need to make quick and accurate trading decisions.

Since scalping is driven by technical analysis, you should consider using other technical indicators as well.

- Exponential Moving Average : this average has been specifically weighted to react more sensitively to recent price movements. When using the EMA chart, be careful of potential “crossovers”.

- Moving Average Convergence Movement (MACD) : a trend-earning momentum indicator that balances a 26-period and 12-period moving average. Despite what you may assume, MACD can be used in any trading time frame.

- Bollinger Bands : these useful bands contain most of the price movement (about 95 percent). Use these bands to help determine when breakouts and reversals are most likely to occur.

- Relative Strength Index : RSI is a momentum indicator that measures the level of strength and resistance on a scale of 1 to 100. This can help limit the possible risks attached to scalping.

These indicators will help you create your scalping strategy with better confidence. As long as you can consistently follow our strategy and carefully include stop losses, scalping is a trading strategy that will develop naturally.

Conclusion – The Best Scalping Strategy

Simple Scalping Strategy can be a powerful 1-minute scalping system too and if you try it on the time frame, let us know your results! We can use the best scalping strategy indicator (volume) and have the talent of the whole strategy to use with it. The reason is that it can confirm trends, it can confirm reversals, and it can show us when there is less interest between buyers and sellers.

With this best scalping system, you will find that it is not only easy to scalp but will also find high winning percentage strategies and opportunities to grow your account quickly. If you are not a fan of scalping and enjoy swing trading or day trading strategies be sure to check out the Rabbit Trail Channel Strategy which will show you how to grab 50 pips at a time with a high probability of winning!