The shooting star candlestick strategy explores a small bearish candlestick reversal pattern that looks similar to an inverted hammer. Among traders price action shooting stars are also known as Pin Bars and have some unique price characteristics. This makes it a very “dangerous” pattern if it develops in the right location.

If this is your first time on our website, our team at Trading Strategy Traders welcomes you. Make sure you hit the subscribe button, so you get your Free Trading Strategy every week straight into your email box.

Once you understand what is going on in the trading stars, you will understand why a single candlestick pattern has the power to signal an uptrend reversal. Very few people are good at reversal trading. In fact, most traders do it so badly that they burn their accounts.

The best shooting strategy will address this issue and will show you how to catch a falling knife without cutting our fingers. The shooting star candlestick pattern can help you how to spot the top in the market and how to trade it correctly.

First of all, let’s go over some basics:

Shooting Star Candlestick Chart Pattern – Definition

A shooting star is a bearish reversal chart pattern characterized by a long upper axis, little or no lower axis and a small body. In technical analysis, a shooting star pin bar consists of a single candlestick.

A reversal star strike is only reliable when it occurs at the end of an uptrend.

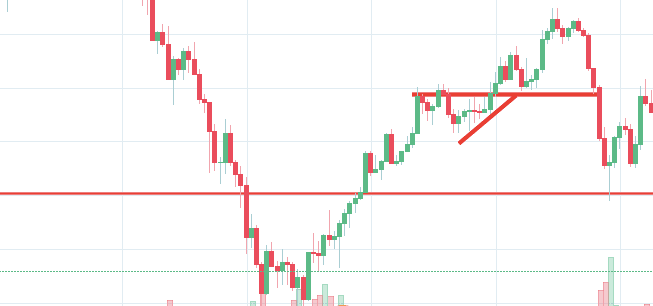

The figure below is a good representation of the Shooting Star candlestick pattern:

Depending on your chart settings, the actual body of the inverted hammer can be green (bullish) or red (bearish). However, the shooting star fell more strongly because the closing price was lower than the opening price.

Another characteristic of the descending shooting star is that the wicks should be at least 2-3 times the size of the body.

Here’s how a real shooting star pattern looks like on a candlestick chart:

To properly understand the bulls and bears behind the shooting star pattern, let’s examine this candlestick pattern in more detail.

To properly understand the bulls and bears behind the shooting star pattern, let’s examine this candlestick pattern in more detail.

Psychology Behind Shooting Stars

Who is in power?

The Bulls? Or Bears?

At first, the cows were in control because the flow increased while continuing to move. Bulls pushed prices to new highs. Once the bulls hit the climax and hit the high candle, everything looks bullish.

However, at this stage, the bears stepped into the market and fought back. They managed to overcome the bulls and drive the price back below the opening price.

In the case of a bearish shooting star, the closing price will be below the opening price and near the low bar. And, in the case of a bullish shooting star, the closing price will be above, but close to the opening price, in its close range.

The ability of the reverse hammer to lower the pressure on the candle close below the opening price gives the bearish shooting star more power to reverse the prevailing uptrend.

What is Trading Star Trading?

We need to train our eyes to read the sentiment of hammer candles, taking into account the overall market environment. It is futile to identify the exact star of the book’s text.

If you do not have an uptrend before the hammer candle reverses, then it is not a reversible candlestick pattern. In this case, shooting star trading will fail.

The shooting star candle is only confirmed once we break below the low candle. But depending on your risk profile, you should seek confirmation from other sources to validate the trade.

We do not recommend being an aggressive trader when trading star chart patterns.

You can propose different types of entry strategies, but be aware that the more points you use, the further the price can move from the ideal entry price.

Now, before we will outline the best shooting star strategy rules. We always recommend taking a piece of paper and a pen and observing these rules.

For this demonstration, we will look at a downward shooting star or an upside down hammer.

Shooting Star Candle Strategy

The shooting star candlestick strategy is a very simple but very effective method for financial market trading. You can trade stocks, Forex, currencies, commodities, futures and even cryptocurrencies on various time frames.

The type of trading setup we will suggest through this reversal trading strategy has an unusually high success rate. However, the only downside is that they will only appear on your Forex candlestick chart once in a while.

Let’s get started and get our feet wet.

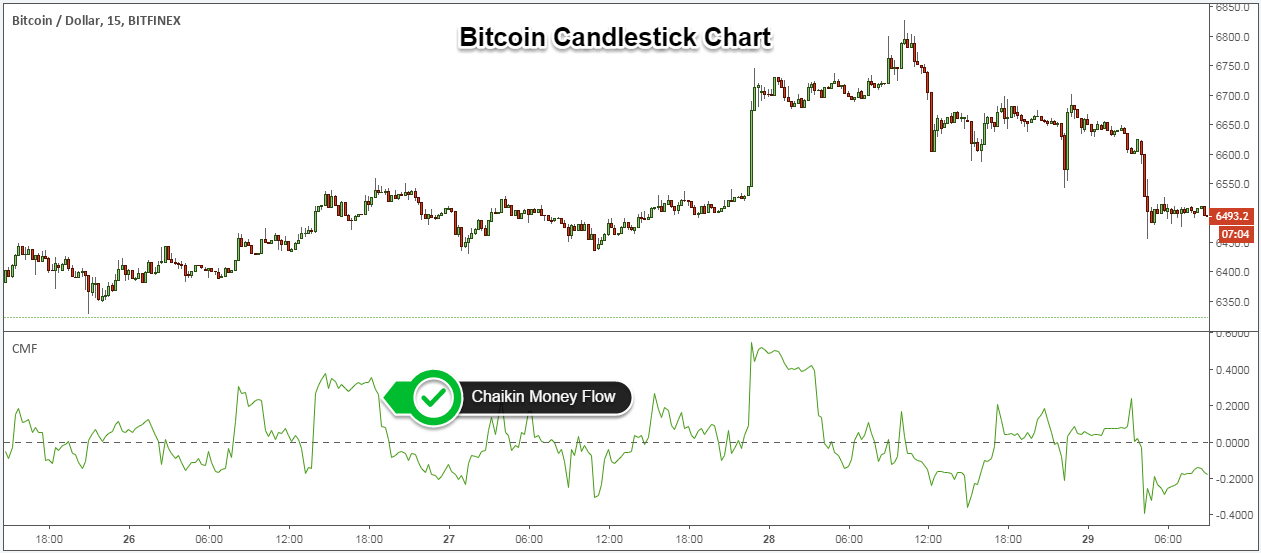

Step #1: Attach the Chaikin Money Flow Indicator to the Time Frame of Your Choice

Start first by getting your chart ready for battle. Simply install the Chaikin Money Flow indicator on your favorite time frame. This is the only additional technical tool we will use to confirm the validity of shooting star patterns.

Using the CMF indicator, we achieve one key point.

The validity of a bearish shooting star will be confirmed or canceled immediately as soon as the inverted hammer drops on our Bitcoin candlestick chart. This means that the price will not move further from the ideal entry price.

Now we focus on price action.

See below:

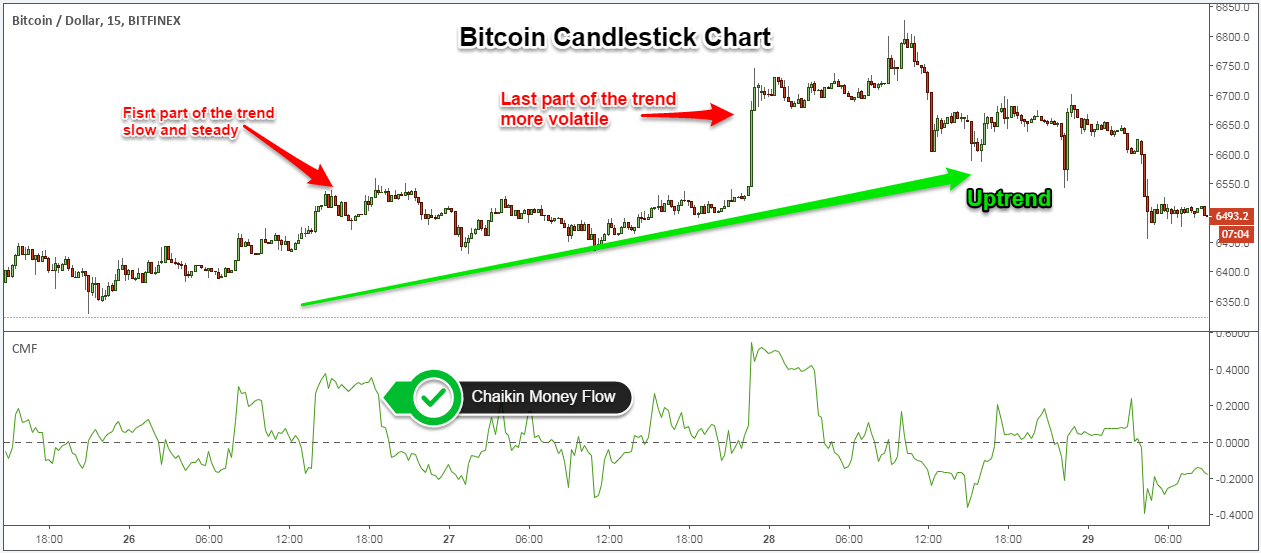

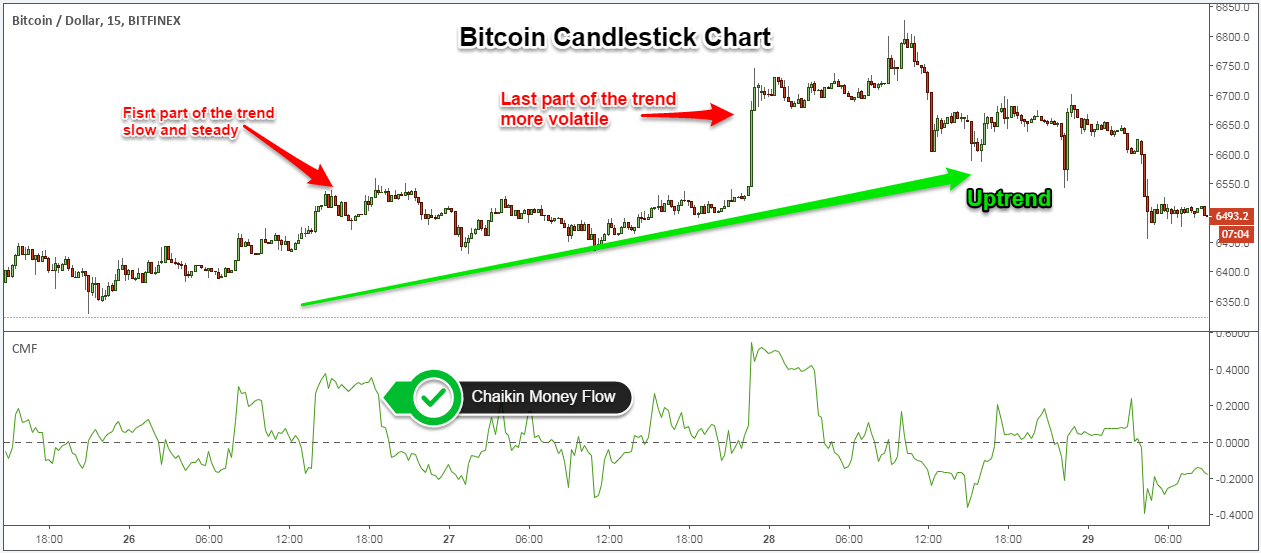

Step #2: The Shooting Star candle should come after a strong uptrend

Location, or where shooting star candles grow, matters a lot.

This whole ingredient is what makes the bearish breakout star candle perform with such high precision. We need a strong uptrend that has two important characteristics:

- The first part of the trend is a slow and steady move up

- The last part of the uptrend, before the shooting star candle, should be more volatile.

Basically, we’re looking for key market segments where the bulls have run out and peaked.

Let’s now zoom into the chart and see if the inverted hammer meets all the requirements.

See below:

Step #3: The CMF indicator must be below the 0 line when the shooting star candle falls

Chaikin’s Money Flow is a great tool for reading and measuring the distribution activity of institutional collections in any market. Basically, a CMF reading below the zero line indicates that sellers have an advantage and they are taking over the market.

Note that the descending shooting star appears to fulfill all the requirements of a descending inverted hammer. The shadow is at least twice as long as the body, a small body, and a very low shadow. This candle will be more powerful if the closing price is below the opening price.

But it is still a good pattern to trade because of all the other features.

Now, it’s time to highlight how to find the right entry point to shoot the star cross.

Step #4: Sell as soon as we break the low of the Shooting Star Candle

Just place a limit sell order below the low of the shooting star. There is nothing complicated about our entry strategy. This is in line with textbook rules.

What is the best place to hide your protective stop loss? Where should you exit a profitable trade when trading shooting candlesticks?

See below:

Step #5: Hide the SL above the height of the Shooting Star Candle. TP when we get into the slow part of the trend that happens.

Just keep your SL guard above the shooting star pattern height. You can add a buffer of several pips if you want to protect against possible false breakouts.

The contaminated top created the necessary space where the bear would not have any level of support to stop the descent. The latter stage of the trend has always been more volatile. When combined with the reversal shooting star pattern, it makes for a killer trading strategy.

In this case when the price reaches the part where the flow increases while moving slowly, we take profit. This is where the price will create hostility to further advance the weakness. We want to clear our position when that happens.

Conclusion – Best Shooting Star Strategy

The best shooting strategy is one of the most reliable and efficient ways to change the direction of the trend. This single candlestick pattern can provide you with one of the most attractive risk to reward ratios. You can risk between 10 and 30 pips and see a profit between 200 and 300 pips which gives you a profit of 20x or 30x the risk taken.

Take note the next time you find a shooting star candle that meets all the rules outlined in this trading strategy guide.

Many traders will warn you against trading reversals. However, finding market tops and trading reversals can be done successfully if you have a proven methodology like our shooting star candlestick strategy.