The Best Ichimoku Strategy for Quick Profits

The best Ichimoku strategy is a system of technical indicators used to evaluate the market. This unique strategy provides trading signals of different quality. Forex trading involves the risk of large losses. Although, with Ichimoku cloud trading, those losses are contained and kept small.

The Ichimoku system is a Japanese charting and technical analysis method. Our team at Trading Strategy Traders mastered the method over a long period of time.

The Ichimoku indicator was published in 1969 by a journalist, Ichimoku Kinkou Hyo, in Japan. This candlestick trading technique has stood the test of time.

The name Ichimoku tells a lot about the trading system, or at least it gives an idea of the system.

Ichimoku = “One look, look”.

Kinkou = “Balance, balance”.

Hyo = “Chart, Graph”.

The Ichimoku cloud experiment attempts to identify possible price directions. It helps traders determine the most appropriate time to enter and exit the market by providing you with the direction of the trend. It gives you reliable support and resistance levels and the strength of these market signals.

Before we delve further into the Ichimoku Cloud strategy, let’s look at the indicators needed to successfully trade the strategy.

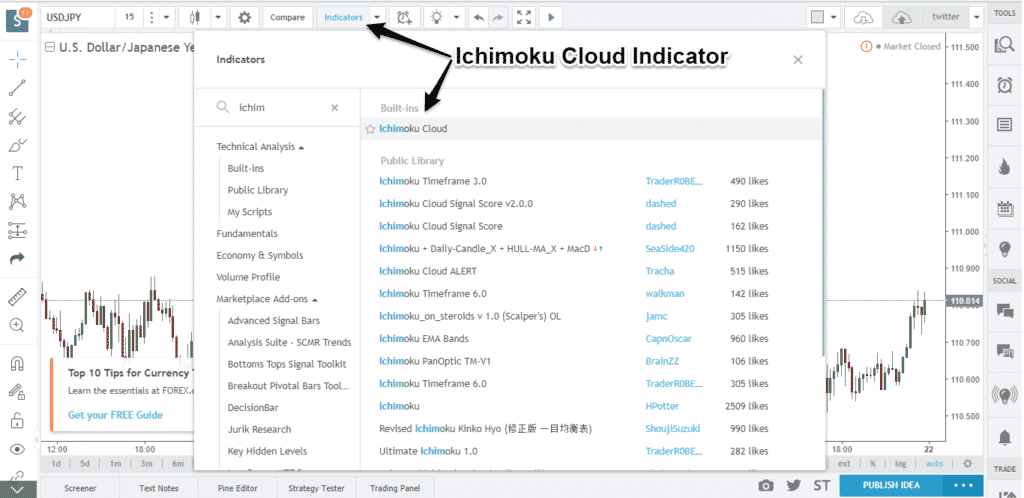

The most popular Forex trading platform uses the Ichimoku Cloud indicator. The Ichimoku indicator paints all the necessary components to help better visualize price action. Ichimoku cloud is one of the most comprehensive technical indicators in modern use. Unsurprisingly, it quickly became the “go-to” indicator for forex traders around the world.

In the Ichimoku cloud section, we will give you an in-depth overview of the Ichimoku components.

So, before moving forward, let’s describe all the components of Cloud Ichimoku. We will examine how to interpret the trading signals produced by this technical indicator.

Ichimoku Cloud Explained

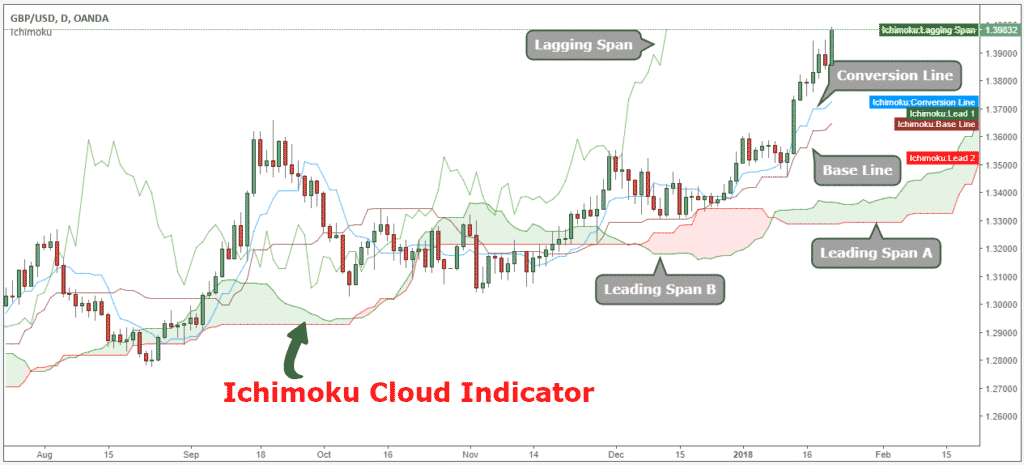

Ichimoku Hinko Hyo is a momentum indicator used to identify the direction of the trend. It can also determine the exact support and resistance levels. The Ichimoku Cloud indicator consists of five main components that provide you with reliable trading signals:

- The Tenkan-Sen bar, also known as the Conversion Line, represents the midpoint of the last 9 candlesticks. It is calculated with the following Ichimoku formula: [(9-period high + 9-period low) / 2].

- The Kijun-Sen line, also known as the Base Line, represents the midpoint of the last 26 candlesticks. It is calculated with the following formula: [(26-period high + 26-period low) / 2].

- Chiou Span , also known as Lagging Span, lags behind in price (as the name suggests). The Lagging Span has drawn up 26 return periods.

- Senkou Span A , also known as the Leading Span, represents one of the two Cloud boundaries and the midpoint between the Conversion Line and the Base Line: [(Conversion Line + Base Line) / 2]. This value has been drafted 26 periods into the future and it is the limit of the Cloud faster.

- Senkou Span B , or Span Span B, represents the boundary of the second Cloud and the midpoint of the last 52 price bars: [(52-period high + 52 period low) / 2]. This value is projected 52 periods into the future and it is the slower Cloud boundary.

- Chikou Span , represents the closing price and is plotted 26 days away.

Although the Ichimoku Cloud indicator involves several (five) different lines, reading the graph is actually very easy. Using the aforementioned trend lines, you need to determine whether Span A or Span Lead is currently higher.

Once Span A and the Leading Span have been identified, the “cloud” component of this graphic will be shaded. When Span B is leading above Span A, this indicates to the trader that price momentum is increasing. When this happens, the graph will be green.

Conversely, when Span A is below Main Span B, the underlying asset may move in a negative direction. When this happens, the cloud will be red. Despite the graphic complications, just looking at the color of the clouds can help you determine the direction of the market.

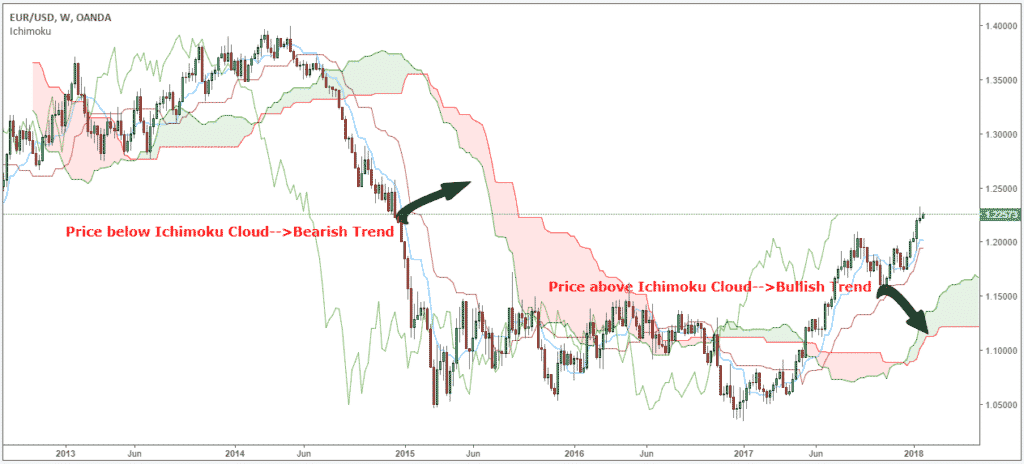

Here are some basic interpretations of the Ichimoku chart:

- When the price is above the Cloud, we are in an uptrend.

- When the price is below the Cloud, we are in a downtrend.

- When the price is in the middle of the cloud the trend is consolidating or circling.

Additionally, the Ichimoku chart technique provides bullish and bearish signals of various strengths.

When the Tenkan crosses the Kijun from below, it is considered a bullish signal. When Taken crosses Kijun from above, it is considered a bearish signal. The Kijun line is shown as the red line above.

The strength of Ichimoku trading signals is evaluated based on three factors:

- How far is the price movement relative to the Cloud?

- How far is the Chiou Span relative to the Clouds?

- How Cross-over compared to the Cloud?

Because many lines on an Ichimoku Cloud Chart are created using averages, the chart is often compared to a simple moving average chart. However, Ichimoku is more dynamic than simple moving average charts because it is designed to help detect changes in support and resistance.

The relationship between Leading Span A and Leading Span B will indicate either a downtrend or a strong uptrend. Note both the color (green for ascending, red for descending) and the size of the cloud. If the “cloud” between these lines is small, then the trend will not be very strong.

Ichimoku clouds are useful for day traders and others who need to make quick decisions. Clouds are often paired with other technical indicators, such as the Relative Strength Index, in order for traders to get a complete picture of resistance and support. Many traders will also look at crossovers to determine when the trend has reversed.

Ichimoku cloud trading requires a lot of self-discipline. This is because you need to wait for the best trading signals. We will use Cloud Ichimoku’s system default settings.

Now, let’s move forward and learn how to make money using the Ichimoku trading rules.

Note * Going forward, we will not delete Lagging moving averages from our charts. This is because we do not base our trading decisions on lagging price.

Best Ichimoku Strategy – Buy Rules

The Ichimoku Cloud System is designed to keep traders on the right side of the market. Our trading rules will help you follow the trend as long as possible. At least until it’s clear that a reversal is happening. The Ichimoku system suits the best trades. This is because it maximizes profits while minimizing the risks involved in trading. Here’s how to recognize the right swings to increase your profits.

The best time frame of Ichimoku Kinko Hyo is the one that suits you best. Since we do not have a preferred time period.

This swing trading strategy will teach you how to ride the right trend from the start. You will also learn how to capture as much profit as possible.

Ichimoku Cloud Trading: Step by Step

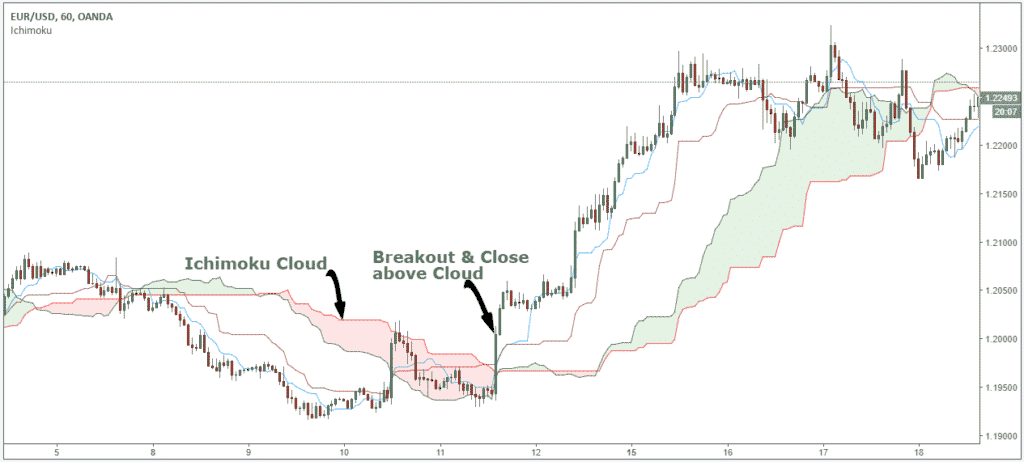

Step #1 Wait for Price to Break and close above the Ichimoku Cloud.

Ichimoku cloud trading requires a price to trade on the Cloud. This is because it is a bullish signal and potentially the start of a new trend.

Clouds are built to highlight support and resistance levels. It highlights several layers of depth because support and resistance are not a line drawn in the sand. It is several layers deep.

Therefore, when we break above or below the Ichimoku Cloud, it signals a profound shift in market sentiment.

High probability trade setups require more layers of encounters before pulling the trigger.

This brings us to the next requirement for a high probability trading setup.

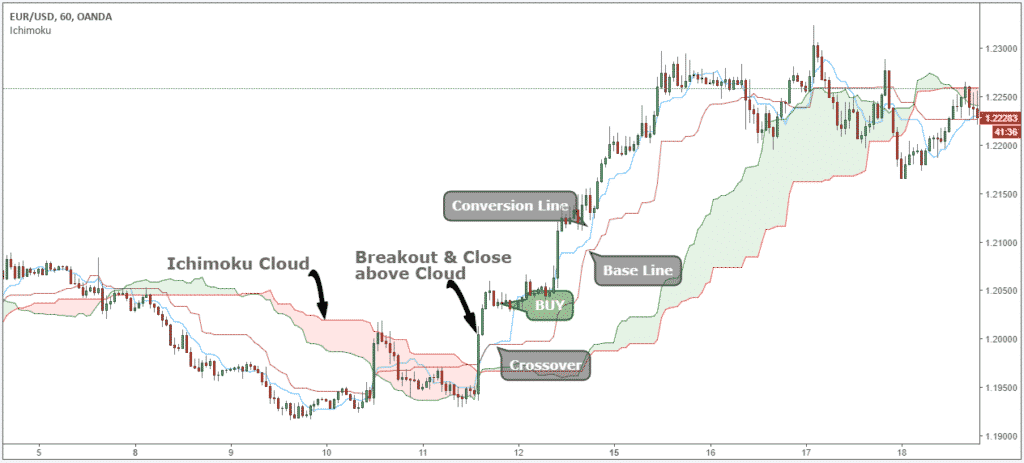

Step #2 Wait for the Crossover: The Conversion Line should cross the Base Line.

A breakout above the Cloud requirement is followed by a Conversion Line crossover above the Base Line. When these two conditions are met, we can look to enter the trade.

The Ichimoku Cloud indicator is a very complicated technical indicator. This indicator is also used as a moving crossover strategy.

Now, we will lay out a very simple entry technique for the Ichimoku Kinko Hyo trading system.

See below….

Step # 3 Buy after the crossover at the opening of the next candle.

Ideally, any long trades using the Ichimoku strategy are taken when the price trades above the Cloud. Our team at the TSG website has taken a more conservative approach. We add one additional factor of encounter before pulling the trigger on a trade.

So, after the crossover, we buy at the opening of the next candle.

(Notice the strong buy signal in the graph below.)

The next important thing we need to determine is to place our protective stop.

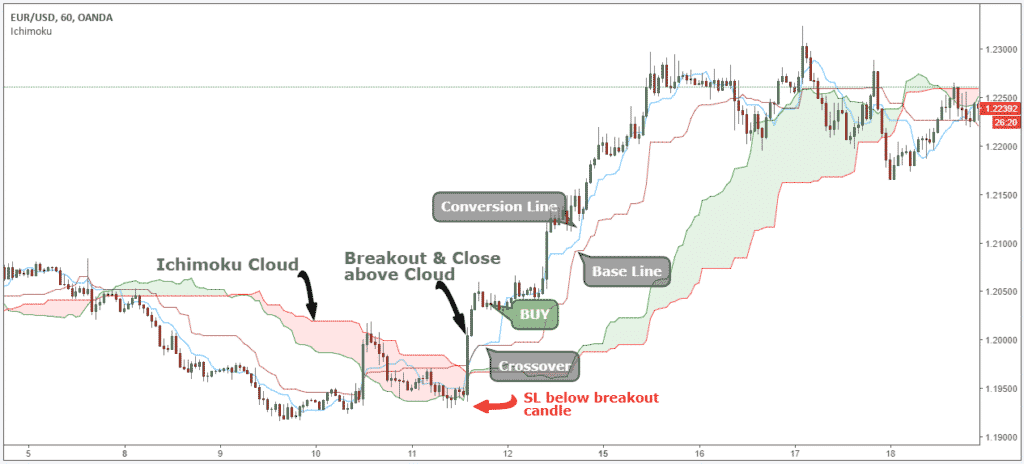

Step #4 Place a protective stop below the breakout candle.

The ideal location to hide our protective stop is below the low of the breakout candle. This trading technique accomplishes two main things. Here is an example of a master candle setup.

First, it significantly lowers the risk of losing big money. Second, it helps us trade with market order flow.

Since this is a swing trading strategy, we are looking to capture as much of this new trend as possible. We will look for a trail of stops below the Cloud or out of position as soon as a new crossover occurs in the opposite direction.

The next logical thing we need to determine for the Ichimoku trading system is where to take profit.

See below…

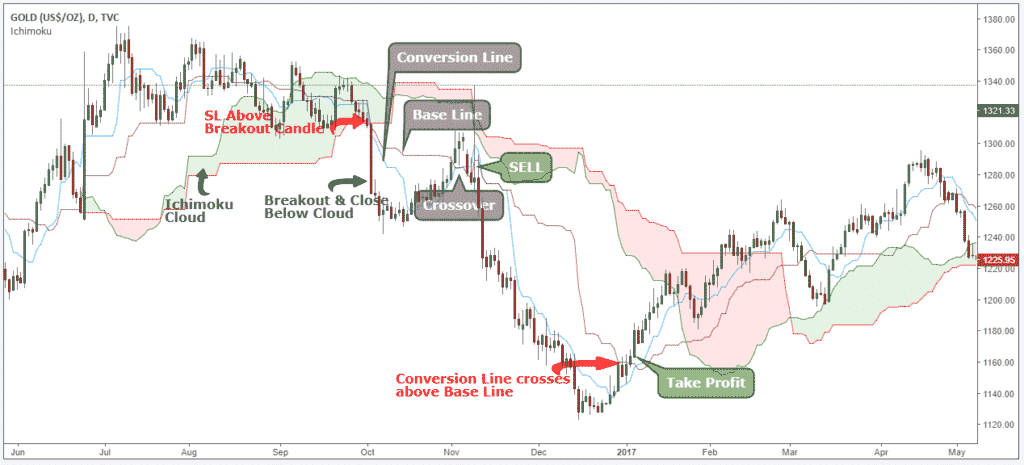

Step #5 Take Profit when the Conversion Line crosses below the Base Line.

We only need one simple condition to be met with our profit taking strategy.

When the conversion line crosses the baseline we want to take profit and exit our trade.

Alternatively, you can wait until the price breaks below the Cloud, but this means the risk of losing some part of your profit. To get more, sometimes you have to be willing to lose some.

Note ** above is an example of a BUY trade using an advanced Ichimoku trading strategy. Use the same rules for SELL trades – but in reverse. In the picture below, you can see an example of a real SELL trade

Conclusion: Ichimoku Cloud Explained

The best Ichimoku strategy is a little different than probably anything you are used to when it comes to technical analysis. If you have a really hard time finding real support and resistance, please use the Ichimoku cloud trading technique highlighted in this course.

We hope that by now you are convinced that the Ichimoku Cloud system is a good way to identify trends and profit from trading any market at any time. It can easily capture 80% of trends if you follow the rules in the Cloud Ichimoku explanation section.

Thank you for reading!

Please leave a comment below if you have any questions about the Best Ichimoku Strategy!